As we step into 2024, the cloud computing landscape continues to evolve with a mix of established giants and emerging players. While Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) still dominate the market, several other providers are gaining traction by offering specialized services or catering to specific niches such as AI. Here’s a look at the top cloud providers worldwide in 2024.

What Is A Cloud Service Provider?

A Cloud Service Provider (CSP) is a company that offers a variety of cloud computing services to businesses and individuals over the internet. These services include computing power, storage, networking, databases, and other infrastructure elements, all hosted in data centers managed by the CSP. By leveraging a cloud providcer, users can access and scale these resources on-demand without having to manage or maintain the physical hardware themselves.

CSPs typically offer their services through several models:

- Infrastructure-as-a-Service (IaaS): Provides virtualized computing resources over the internet.

- Platform-as-a-Service (PaaS): Offers hardware and software tools for application development.

- Software-as-a-Service (SaaS): Delivers software applications over the internet on a subscription basis.

Benefits Of Cloud Providers Vs. On-Premises?

Cloud providers offer several advantages over on-premises solutions, including lower capital expenditures (CAPEX) since there is no need for significant upfront investment in hardware. They also enable faster time-to-market by providing readily available resources. Additionally, cloud services offer scalability and flexibility, allowing businesses to easily adjust resources based on demand. With managed services and access to expert support, organizations benefit from reduced maintenance burdens and enhanced reliability. Cloud providers also offer global reach and availability, ensuring seamless access to services and data from anywhere in the world.

What are the Challenges Of Using a cloud provider?

1. Data Security and Privacy Concerns

Using a public cloud involves storing and processing data on third-party infrastructure, which can raise concerns about data security and privacy. Although CSPs implement stringent security measures, the shared nature of the cloud environment can still present risks.

2. Dependency and Vendor Lock-In

Relying heavily on a single Cloud Provider can lead to vendor lock-in, where switching providers becomes technically difficult or cost-prohibitive. Different CSPs have unique architectures, services, and APIs, which can make migration complex.

3. Cost Management and Visibility

While cloud computing can be cost-effective, it can also lead to unexpected expenses if not managed properly. The pay-as-you-go model is convenient, but without proper oversight, costs can spiral out of control. Businesses need to implement robust cost management practices and use tools to gain visibility into their cloud spending.

4. Limited Control Over Infrastructure

While cloud providers offer managed services, some businesses may feel constrained by the limited control they have over the underlying infrastructure. This can be a concern for companies with specific performance, compliance, or customization needs that the CSP’s standard offerings may not meet.

5. Performance and Reliability Issues

Although CSPs aim for high availability and performance, outages and service disruptions can still occur. Businesses relying on CSPs must have contingency plans, such as multi-region deployments or hybrid cloud solutions, to mitigate the impact of any potential downtime.

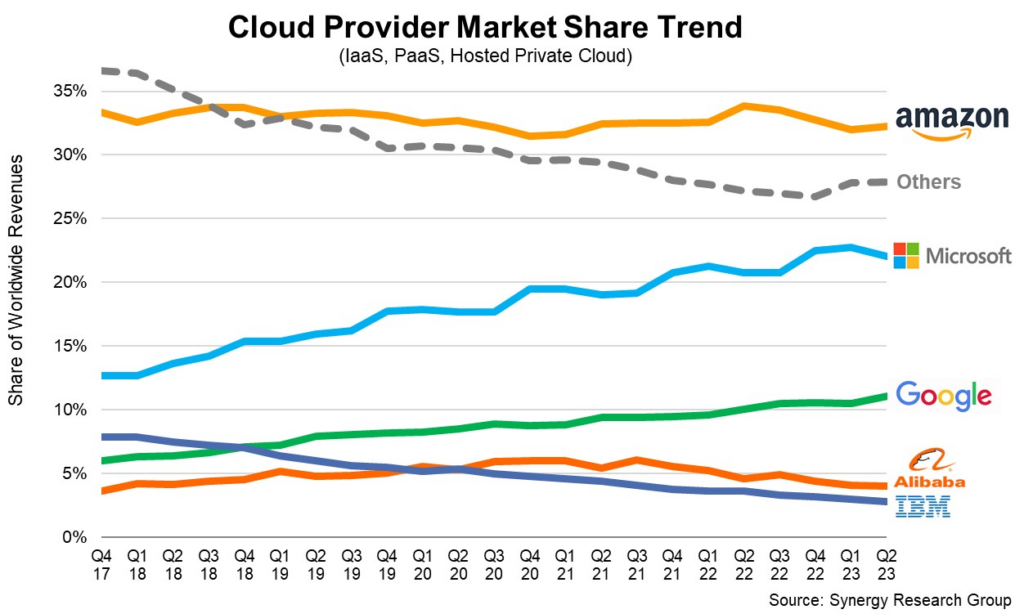

Cloud market share 2024 in a nutshell

The cloud computing market continues its impressive growth. According to Canalys, total spending on cloud infrastructure services surged by 18% in 2023, reaching $290.4 billion, up from $247.1 billion in 2022. This growth trend has accelerated into the first quarter of 2024, with Azure, Google Cloud Platform (GCP), and AWS reporting year-over-year quarterly growth of 31%, 28%, and 17%, respectively.

The market is predominantly controlled by three major players, who together hold 67% of the market share. AWS leads with 31%, followed closely by Azure at 25%, and Google Cloud at 11%.

Despite AWS’s slightly lower quarterly growth compared to Azure and GCP, its market share has remained stable over the years. Azure has seen significant gains, doubling its market share from 12% to 25% in just seven years, largely due to its strong enterprise network and ability to attract large customers. Similarly, GCP has also doubled its market share over the past six years and recently achieved profitability.

As AI continues to drive cloud market expansion, there is growing speculation about whether AWS can maintain its dominance. Azure’s significant investment in OpenAI and GCP’s success with Bard/Gemini and its reputation in AI and machine learning pose serious competition. AWS’s $4 billion investment in Anthropic is notable, but whether it will be enough remains to be seen.

Top Cloud Providers In 2024

1. Amazon Web Services (AWS)

Amazon Web Services remains the largest cloud service provider in the world, with 31% market share of the cloud computing market. AWS offers an extensive range of services, including Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). With over 200 fully-featured services, AWS is the go-to choice for enterprises looking for scalability, reliability, and a global presence with 34 regions available at AWS and more than 105 Availability zones as of June 2024.

Amazon Web Services (AWS) reported robust financial performance in both Q1 and Q2 of 2024, with revenues hitting $25.04 billion in the first quarter and $26.3 billion in the second. This growth builds on a strong 2023, where AWS saw its revenue rise from $80 billion to $90 billion, marking a notable 12.5% year-over-year increase. If this upward trend continues, AWS is on track to potentially surpass the $100 billion revenue mark in 2024.

One aspect that AWS is famous for is it’s truly incredible customer support.

2. Microsoft Azure

Microsoft Azure is a close competitor to AWS, offering a comprehensive suite of cloud services that appeal especially to large enterprises. Azure’s strengths lie in its deep integration with Microsoft’s software ecosystem, making it particularly attractive to enterprises already invested in Microsoft products like Office 365 and Windows Server.

Azure provides more than 200 services, including Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), Software-as-a-Service (SaaS).

Azure 2024 cloud market share is 24% and it’s growing year after year. Looking back, Azure’s quarterly revenue was $5 billion in 2018, and it has since grown to approximately $25 billion, making it the most profitable division within Microsoft. Today, Azure represents nearly half of Microsoft’s total revenue. Azure is catching up on AWS with stronger growth rate than AWS (19%). Indeed Azure announced Q1 2024 and Q2 2024 growth of respectively 29% and 30%.

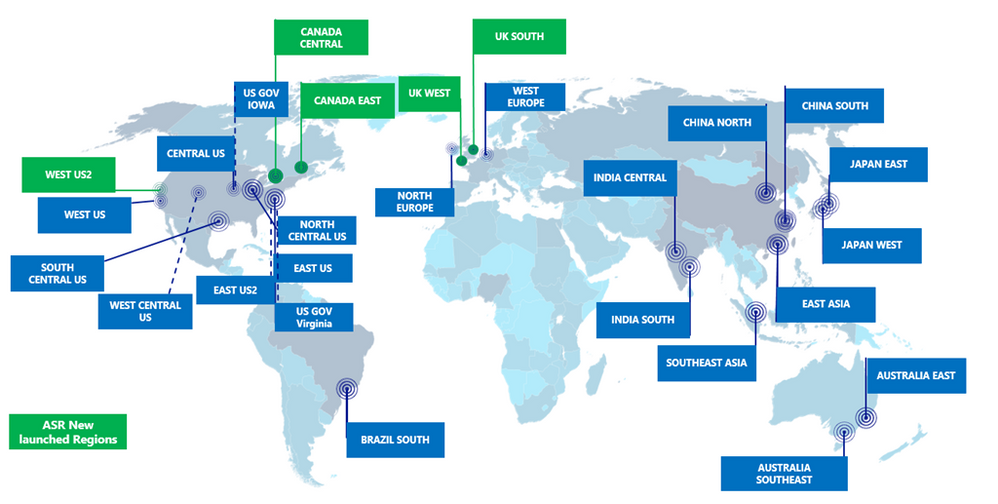

Azure also has a global presence with more than active 40 Regions and more than 120 Availability Zones around the world.

3. Google Cloud Platform (GCP)

Google Cloud Platform is the third cloud provider with 11% market share. GCP offers the same services as AWS and Azure such as IaaS, PaaS and SaaS but is also very renowned for its expertise in data analytics, machine learning, and artificial intelligence. GCP is the preferred choice for businesses that prioritize cutting-edge technology and innovation. Google’s Kubernetes engine has become the industry standard for container orchestration, making GCP a strong contender for companies adopting microservices architectures. GCP is suitable for enterprise of all sizes.

In Q1 2024, Google Cloud achieved remarkable results, with revenue increasing by 28% year-over-year to $9.57 billion. This surge is driven by the growing demand for generative AI tools, which depend extensively on cloud infrastructure, services, and applications. This upward trajectory continues from the notable 25.66% year-over-year growth reported in Q4 2023.In 2023, Alphabet, the parent company of Google Cloud Platform (GCP), generated $305 billion in revenue, with the Google Cloud segment accounting for 10% of this total.

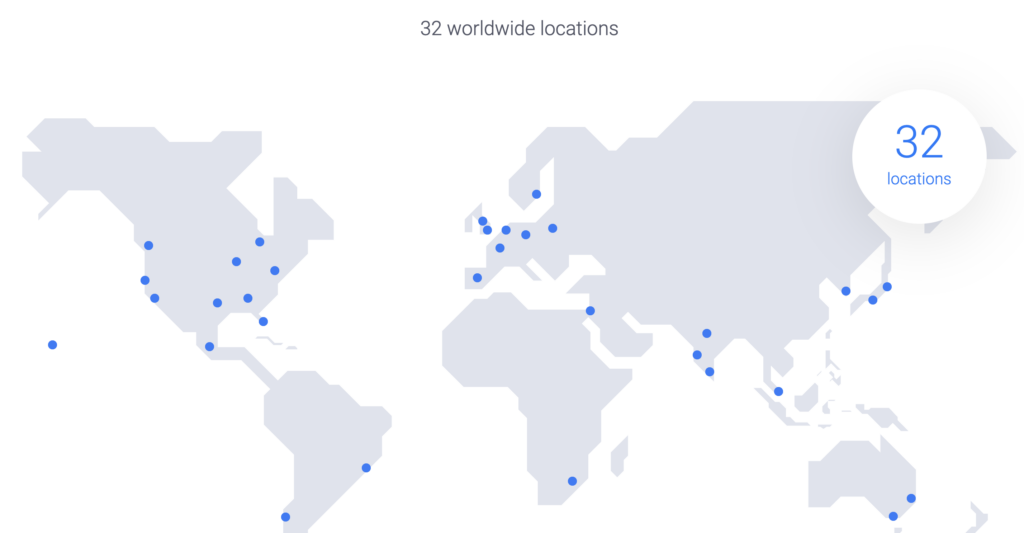

Google Cloud’s infrastructure coverage is nearly as extensive as that of AWS and Azure with more than 40 regions available and 121 Zones worldwide.

4. Alibaba cloud

Alibaba cloud is the 4th largest cloud provider jut after AWS, Azure and GCP. If you are located in Asia or want to serve customer in southeast Asia, Alibaba may be the right choice. The chinese #1 provider manages 89 availability zones across 30 regions worldwide, with plans to expand into additional global regions.

Alibaba currently has 4% market share worldwide and is the first cloud provider in China. They serve more than 3 million customers operating in many different industries and of different sizes. Alibaba Cloud offers a range of cloud computing services, including IaaS, PaaS, DBaaS, and SaaS. Their offerings encompass e-commerce, big data, databases, IoT, object storage (OSS), Kubernetes, and data customization

5. Oracle Cloud Infrastructure (OCI)

Oracle has faced challenges in being recognized as a serious cloud provider. Once known for its traditional approach and reliance on on-premises legacy databases, the 50-year-old company has been consistently expanding its global data center infrastructure and cloud platform to become the 5th larget cloud provider with a 3% market share. Oracle’s growth is now fueled by its cloud computing division. In Q3 2024, Oracle total cloud revenue increased by 24% to $5.1 billion. IaaS drove this growth with a remarkable 49% rise, reaching $1.8 billion in revenue, while SaaS revenue saw a robust 14% increase, totaling $3.3 billion. This quarter, Oracle achieved a significant milestone as its total cloud revenue exceeded its total license support revenue for the first time.

OCI offers a full range of cloud services, including IaaS, PaaS, and SaaS, with a strong emphasis on security and performance. Oracle’s multi-cloud and hybrid cloud capabilities also make it a versatile option for enterprises. Oracle also benefit from a last mover advantage and has very interesting cost to performance ratio compared to AWS, Azure and GCP. Moreover the free tiers offered by Oracle are generous.

OCI offer more than 100 cloud services from 50 public cloud regions in 24 countries.

6. IBM Cloud

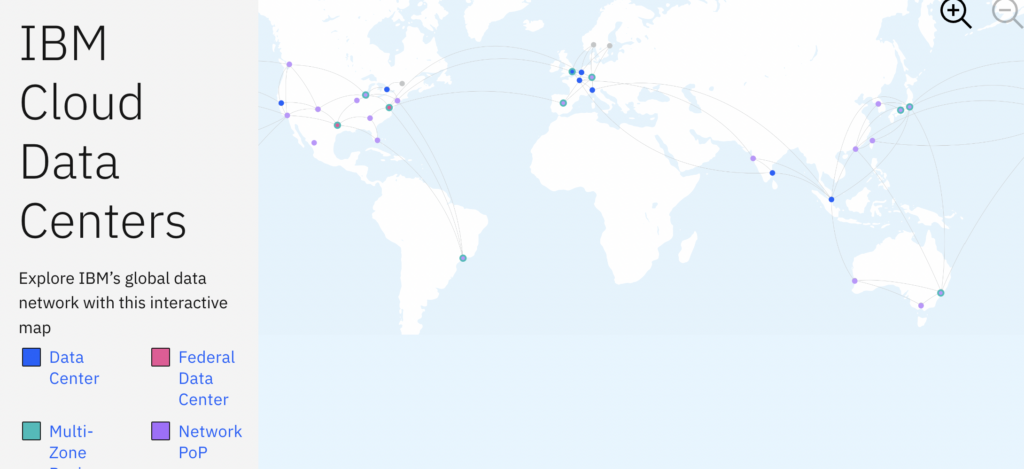

IBM Cloud, a prominent cloud provider and subsidiary of IBM, has established itself as a key player in the enterprise cloud market. Known for its focus on large enterprises and mission-critical workloads, IBM Cloud offers a Hybrid cloud platform powered by Redhat Openshift technology. These services are designed to meet the complex and specialized needs of businesses across various industries, with a strong emphasis on security, reliability, and regulatory compliance.

IBM cloud division has been fueled by many acquisitions including Red Hat and more recently the Big Blue acquired Apptio Cloudability recognized for its cloud cost management platform. In 2024 IBM announced that they have the intention to acquire Hashicorp the company behind Terraform.

IBM Cloud has around 60 data centers in 10+ countries.

7. OVHcloud

OVHcloud, the largest European cloud provider based in France, is rapidly gaining recognition for its strong commitment to data sovereignty and privacy. With 2,900 employees and €897 million in revenue in 2023, OVHcloud offers a diverse range of services, from bare metal servers to public cloud solutions, all with a focus on compliance with European data protection regulations.

While OVHcloud’s product offerings may not be as extensive as those of the hyperscalers, it effectively covers essential services like compute, storage, and networking at a significantly lower cost. For instance, their S3 equivalent storage product is three times cheaper than AWS. This makes OVHcloud an appealing choice for businesses operating in Europe or those prioritizing data privacy.

OVHcloud is also committed to environmental sustainability, boasting one of the industry’s best power usage effectiveness (PUE) ratios at 1.29. The company aims to minimize its reliance on carbon-based energy by 2025, focusing on renewable sources and other low-carbon options such as nuclear and hydroelectric power.

OVhcloud currently has 43 datacenters/ Local Zones worldwide and is expanding rapidly.

8. HPE greenlake

HPE GreenLake, the cloud services division of Hewlett Packard Enterprise (HPE), has firmly established itself as a leader in the hybrid cloud market by delivering flexible, as-a-service solutions tailored to enterprise needs?

HPE’s strategic shift toward edge computing, hybrid cloud, and AI—delivered through the HPE GreenLake platform—is driving higher recurring revenue and gross profit, particularly through an increased mix of high-margin software and services. In Q3, HPE GreenLake achieved an annualized revenue run-rate (ARR) of $1.3 billion, representing a 48% year-over-year increase. Notably, high-margin software and services now make up 68% of the total ARR mix, up two percentage points from the previous quarter.

HPE GreenLake continues to attract new customers while encouraging existing ones to expand their contracts. The platform now supports 27,000 unique customer logos and 3.4 million connected devices.

With its strong focus on innovation and customer needs, HPE GreenLake remains a key player in the hybrid cloud market, offering enterprises a balanced and scalable approach to cloud adoption that aligns with their technological and regulatory requirements.

9. DigitalOcean

DigitalOcean, a listed cloud provider based in the United States, has built a strong reputation for catering to developers, startups, and small-to-medium-sized businesses (Average revenue per customer of 99.45 in 2023). With a focus on simplicity and affordability, DigitalOcean offers a streamlined suite of cloud services, including virtual machines, managed databases, and object storage, designed to meet the needs of businesses that require straightforward and cost-effective solutions.

DigitalOcean’s product offerings may not be as extensive as those of larger cloud providers, but it effectively covers essential services like compute, storage, and networking at a fraction of the cost. This makes DigitalOcean an attractive option for businesses that need reliable cloud infrastructure without the complexity and expense associated with hyperscalers. Their pricing structure is notably transparent and competitive, appealing to budget-conscious developers and entrepreneurs.

In 2023, DigitalOcean saw its revenue increase by 20%, totaling $693 million. The company currently has more than 1 700 employees. DigitalOcean currently operates 15 data centers across the globe, with plans for further expansion to meet the growing demands of its customer base.

10. Hetzner

Hetzner, a leading European cloud and web hosting provider based in Germany, has built a strong reputation for offering reliable, high-performance infrastructure services at very competitive prices. Catering to a wide range of customers, from individual developers to large enterprises, Hetzner provides an extensive portfolio of services, including virtual private servers (VPS), dedicated servers, managed hosting, and cloud storage solutions. Known for its robust infrastructure and cost-effectiveness, Hetzner has become a popular choice for businesses seeking powerful cloud solutions without the high costs typically associated with larger providers.

One of Hetzner’s key strengths is its commitment to delivering high-quality infrastructure services at some of the most competitive prices in the market. This focus on affordability, combined with reliable performance, makes Hetzner an attractive option for businesses and developers looking for scalable cloud solutions that won’t break the bank. Environmental sustainability is also a key focus for Hetzner.

Hetzner’s revenue in 2021 reached €367 million. Hetzner’s global reach continues to grow, with data centers located in Germany, Finland, Singapore and the United States. This expansion allows Hetzner to serve a diverse and growing customer base, providing low-latency access to its services across multiple regions.

11. Akamai/Linode

Linode, a prominent player in the cloud hosting market, was acquired by Akamai in 2021 to enhance its cloud computing capabilities. With a focus on simplicity and cost-efficiency, Linode reported revenues of $130 million in 2021 and continues to be a significant provider in the cloud infrastructure space. The company specializes in providing a range of cloud services including scalable virtual private servers, block and object storage, and managed Kubernetes clusters.

Since the Akamai acquisition, Linode is moving upmarket and focuses on larger enterprises than before. Akamai leverages its CDN infrastructure to deliver high-performance and secure content distribution, which is complemented by Linode’s cloud computing solutions. This integration aims to provide a comprehensive suite of services, including enhanced cloud infrastructure and edge computing solutions, to meet the evolving needs of businesses and developers worldwide.

12. Scaleway

Scaleway, a prominent European cloud provider based in France, has made significant strides in the cloud market by offering a diverse range of services that cater to startups, developers, and enterprises alike. The french cloud player’s revenue is above $100M in revenue and count more than 500 employees.

Known for its commitment to simplicity, transparency, and environmental sustainability, Scaleway provides a wide array of cloud services, including virtual instances, bare metal servers, object storage, and Kubernetes-based solutions. These offerings are designed to meet the needs of businesses looking for reliable, cost-effective cloud infrastructure with a strong emphasis on data sovereignty and European compliance.

One of Scaleway’s standout features is its focus on delivering high-performance cloud services at competitive prices, making it an attractive option for businesses that need robust cloud infrastructure without the complexity or cost associated with larger providers. Scaleway’s pricing model is clear and predictable, with no hidden fees, which appeals to budget-conscious businesses and developers seeking straightforward cloud solutions.

Scaleway currently has 9 data centers in France, the Netherlands, and Poland, with plans for further expansion to meet the increasing demands of its customer base.

13.Vultr

Vultr, a prominent global cloud provider, is renowned for its simplicity, performance, and cost-effectiveness. With a workforce of approximately 200 employees and $150 million in revenue in 2023, Vultr has established itself as a key player in the cloud services market. The company specializes in providing scalable and affordable cloud infrastructure solutions that cater to a wide range of users, from individual developers to large enterprises.

Vultr’s service offerings include a range of essential cloud solutions such as virtual private servers (VPS), block storage, and object storage. Their VPS solutions are particularly noted for their competitive pricing and high performance, often being a more budget-friendly option compared to larger cloud providers. For example, Vultr’s block storage is offered at a significantly lower cost than comparable services from major hyperscalers, making it an attractive choice for cost-conscious customers.

Vultr is also expanding its global footprint, with multiple data centers across various regions to ensure low-latency access and high availability for its customers.

14. Coreweave – AI focus

CoreWeave, a leading cloud infrastructure provider, is recognized for its specialized focus on GPU-accelerated computing, catering to industries that demand intensive computational power such as AI, machine learning, and graphics rendering. The company offers a range of virtual machines equipped with high-performance GPUs, designed to handle complex tasks efficiently. CoreWeave provides flexible GPU configurations to meet diverse needs, from single-GPU instances to multi-GPU setups, alongside general-purpose virtual machines for broader computing requirements. Their storage solutions include high-performance block storage and scalable object storage, supporting data-intensive applications.

Coreweave raised $7,5 Billion in debt in May 2024 and count more than 600 employees. The company operates 3 data centers in the US.

15. Lambda – AI focus

Lambda Labs, a specialized cloud infrastructure provider, is well-regarded for its focus on GPU-accelerated computing, particularly for applications in AI, deep learning, and scientific computing. The company offers a range of high-performance GPU instances, designed to handle the most demanding computational tasks. Lambda Labs’ cloud services are tailored to meet the needs of researchers, engineers, and businesses that require powerful and scalable solutions for training large models and running complex simulations.

In June 2024, they release a killer feature, that enable to launch a GPU cluster in one click instead of a single VM.

They raised $500M in April 2024 to expand and count more than 400 employees.

Choosing the Best Cloud Provider for Your Business

The cloud computing landscape is dynamic, with new players emerging and existing providers continually expanding their offerings. To select the most suitable cloud provider for your business, carefully consider your specific needs, budget, and long-term goals.

Factors to evaluate include:

- Services and Features: Ensure the provider offers the services you require, such as IaaS, PaaS, SaaS, AI, or specialized solutions.

- Pricing and Cost Management: Compare pricing models, evaluate cost optimization tools, and consider the long-term cost implications.

- Performance and Reliability: Assess the provider’s track record for uptime, performance, and customer support.

- Scalability and regional coverage: Ensure the provider can accommodate your future growth and changing needs.

- Security and Compliance: Verify that the provider meets your security and compliance requirements.

- Data Sovereignty: If data residency is a concern, choose a provider with data centers in your desired region.

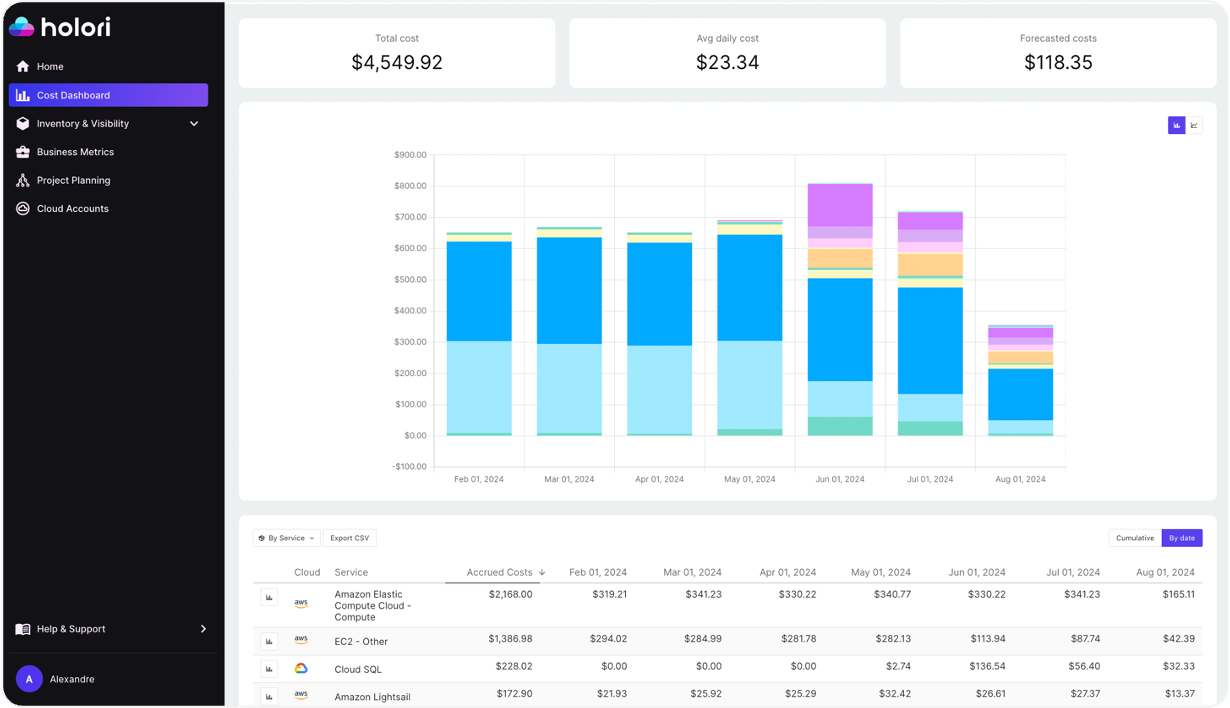

Perhaps the best approach is to use multiple vendors to optimize for performance, cost, or compliance. In this scenario, it’s essential to have the right tools to manage these providers effectively. A FinOps platform like Holori can be particularly valuable, as it helps you visualize your assets, track infra changes, monitor expenses, and optimize costs across multiple cloud environments.

Start managing your cloud providers with Holori Cloud Cost Management Platform! : https://app.holori.com/