The cloud market in Europe is going well. Countless customers, excellent network infrastructure, strong willingness to embrace cloud technologies.

But is it really that bright for European cloud providers?

You all heard about AWS (Amazon Web Services), GCP (Google Cloud), Azure (Microsoft). Subsidiaries of US tech giants Amazon, Google and Microsoft, they are indeed the world leading cloud providers and Europe is no exception to their unrivaled hegemony. While their names are for sure familiar to you, are you as familiar with some of their biggest their European challengers OVH, Hetzner, Scaleway, SAP…?

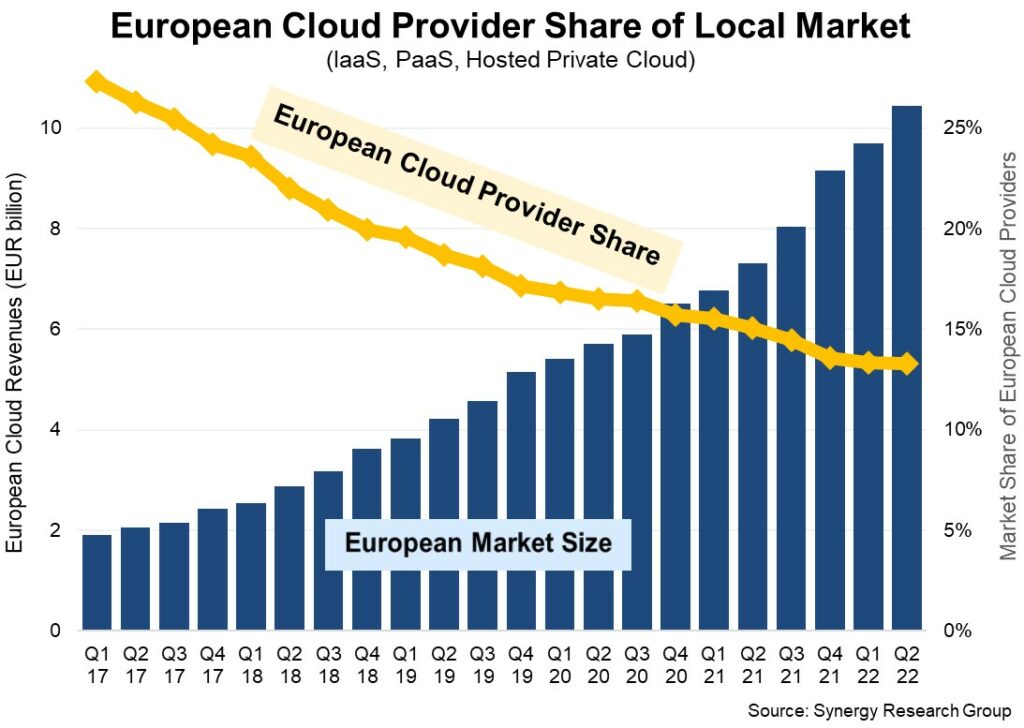

By analyzing the market, Synergy Research recently estimated that European cloud providers have grown their revenues by 167% between 2017 and 2022. Great right?

Not that impressive however, once you know that the European cloud market grew by 500% over the same period reaching 10.4 billion euros (US$10.9 billion) in Q2 2022.

What does it mean?

If you grow by 167% in a market that does 500%, you are losing market shares. This is exactly what happened with a drop from 27% market share to 13% for European cloud providers over 5 years.

The graph below by Synergy Research Group shows the market share loss of European Cloud providers in a fast-growing market.

According to Synergy Research Group the main beneficiaries of the market growth have been Amazon, Microsoft and Google who now capture more than 75% of the cloud market in Europe.

The outlook isn’t optimistic according to Synergy Research Chief Analyst who explains that “as US cloud providers continue to invest over EUR 4 billion every quarter in European capex programs, that presents an impossible hill to climb for any companies who wish to seriously challenge their market leadership. Consequently, European cloud providers have mostly settled into positions of serving local groups of customers that have some specific local needs, sometimes working as partners to the big US cloud providers. Some of those European cloud providers will continue to grow but they are unlikely to move the needle much in terms of overall European market share.”

We recently saw the European law makers trying to push regulations to keep the growth of non-European providers on the EU market

The answer could also be in the hands of European CTO’s who have a strategic decision to make regarding their cloud infrastructure.

The strategy could be to push for real multicloud infrastructure where most services are hosted on regional providers while specific product from AWS and Co could be used when needed and when no alternative exists.

This is a vision we are advocating for at Holori. Use the cloud services that are best for you across providers by removing technological barriers.

Our cloud project calculator available at https://app.holori.com already allows you to design or import your multicloud infra, benchmark it with other providers and provision the resources you need directly from the tool.