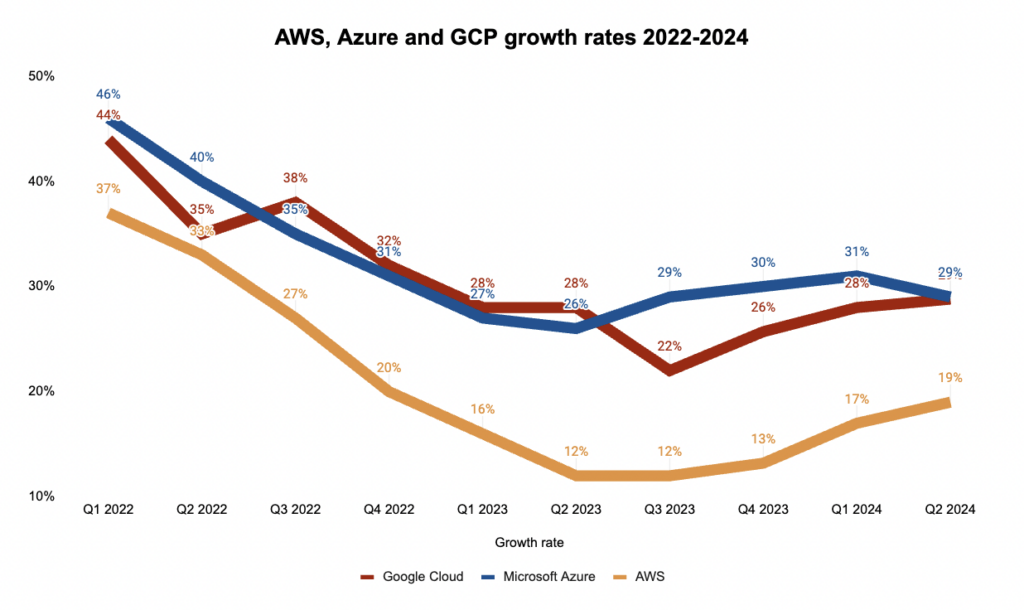

The cloud computing market continues its remarkable growth trajectory. According to Canalys, In 2023, the cloud infrastructure services market boomed, with total spending surging 18% to reach US$290.4 billion, a significant increase from US$247.1 billion in 2022. This momentum has been in acceleration in Q1 2024 with Azure, GCP and Azure announcing respectively YoY quarterly growth of 31%, 28% and 17%. This growth continue in Q2 2024 with Azure, GCP and Azure announcing respectively YoY quarterly growth of 28%, 29% and 19%.

As a reminder the growth rate of Hyperscalers post covid (2022- mid 2023) decreased due to a wave of rationalization fueled by inflation, where companies used massively finops tools such as Holori to reduce their cloud expenditures.

Now in 2024, with the rise of generative AI, the cloud market is growing significantly again. AI tools require significant computing resources, driving demand for cloud infrastructure and propelling cloud service providers forward.

Cloud providers market share

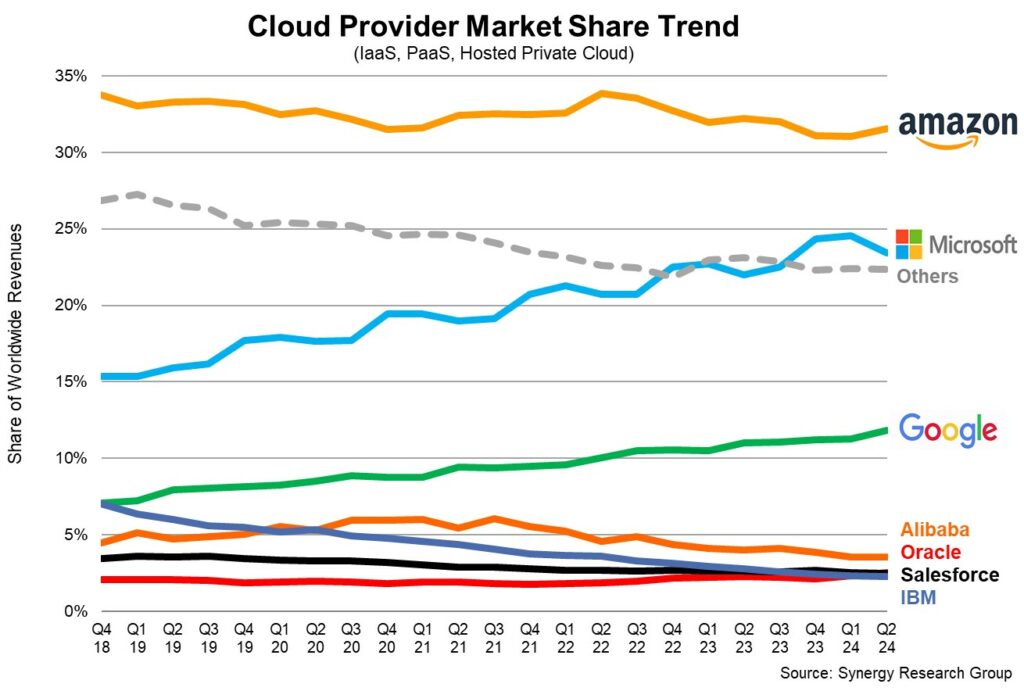

The market is dominated by 3 majors cloud providers sharing 67% of the pie. AWS is the leader with 31% of market share, Azure closely follows with 25% and Google Cloud with 11% of market share.

Despite a smaller quarterly growth rate compared to Azure and GCP, AWS market share remains steady over the years. Azure is the huge winner, in only 7 years, Microsoft has doubled its market share (from 12% to 25%). The great strength of Azure is to be able to leverage their enterprise network and sell to big customers. Over 6 years, GCP has also doubled its market share and became profitable only recently.

With AI fueling the cloud market growth, everybody is wondering if AWS is going to keep its supremacy. Indeed, Azure has taken a huge stake in OpenAi and GCP has released Bard/Gemini and is greatly recognized for machine learning and AI. AWS invested $4 Billion in Anthropic but will it be enough?

AWS

Amazon Web Services (AWS) presents a fascinating case study. Despite a maturing cloud market where its market share hovers around 31%, AWS revenue continues to climb. This seemingly contradictory trend can be attributed to their early mover advantage. Having pioneered commercial cloud services 13 years ago, AWS established a strong foundation and a rich portfolio of features before significant competition emerged.

This head start continues to be a strategic advantage. This translates into a wider range of well-developed and feature-rich services that keep AWS at the forefront of both technical innovation and commercial strategy. In many ways, AWS sets the bar for the entire cloud computing industry, with other players often following suit when they implement new technologies or business models.

Amazon Web Services (AWS) reported strong financial results in their Q1 2024 report, with revenue reaching $25.04 billion. This momentum follows a successful year in 2023, where AWS revenue grew from $80 billion to $90 billion, a significant 12.5% year-over-year increase. Looking ahead, this upward trajectory suggests AWS could potentially reach the $100 billion revenue mark in 2024.

Furthermore, AWS delivered a robust $24.631 billion in operating income in 2023. This operating income plays a crucial role in driving Amazon (group) net income, highlighting the profitability of their cloud business.

Azure

The great power of Microsoft Azure is its offering toward enterprises. They can offer Azure services, Microsoft office, windows licenses, GitHub licenses and even Linkedin licenses. No other company in the world as this broad portfolio and this the key reason why Azure is so successful.

For year 2023, Azure parent company, Microsoft, reported $211 billion in revenue and over $88 billion in operating income.

In 2023, Microsoft’s revenue growth was up 17.7% year-over-year — reaching $96.2 billion — for its Intelligent Cloud offerings. This includes Azure and other cloud services, Office 365 Commercial, the commercial portion of LinkedIn, Dynamics 365, and other commercial cloud businesses (Microsoft does not report Azure revenue separately). Azure 2024 cloud market share is 24% and it’s growing year after year.

Looking backward, Azure was in 2018 at $5B quarterly revenue and is now around $25B making it the most profitable business unit of Microsoft. Azure nowadays accounts for almost half of Microsoft revenue.

The future looks bright for Azure as they are at the forefront of AI after investing a $13B stake in OpenAI.

Google cloud

Google Cloud Platform (GCP) has made significant strides in the cloud market, nearly doubling its market share from 6% in Q4 2017 to 11% in Q4 2023. This impressive growth is reflected in its revenue, which reached $33.1 billion in 2023. Furthermore, GCP’s Q4 2023 earnings saw a strong 26% increase compared to Q4 2022.

Google Cloud delivered a stellar performance in Q1 2024, with revenue surging 28% year-over-year to $9.57 billion. This growth is fueled by the rising demand for generative AI tools, which heavily rely on cloud infrastructure, services, and applications. This momentum continues a positive trend, building on the impressive 25.66% year-over-year growth achieved in Q4 2023.

Further demonstrating its financial strength, Google Cloud’s operating income soared nearly fivefold, reaching $900 million compared to $191 million in the previous quarter.

Alphabet, the mother company of GCP, realized $305B in turnover in 2023, so the Google cloud segment currently represent 10% of Alphabet’s revenue.

Comparing AWS vs Azure vs GCP

It’s fascinating to see how the major cloud providers, often referred to as hyperscalers, began in entirely different industries. Amazon was an online retailer, Google a search engine, and Microsoft an operating system developer. Today, cloud computing is a major driver of their revenue and income, highlighting its remarkable growth and strategic importance.

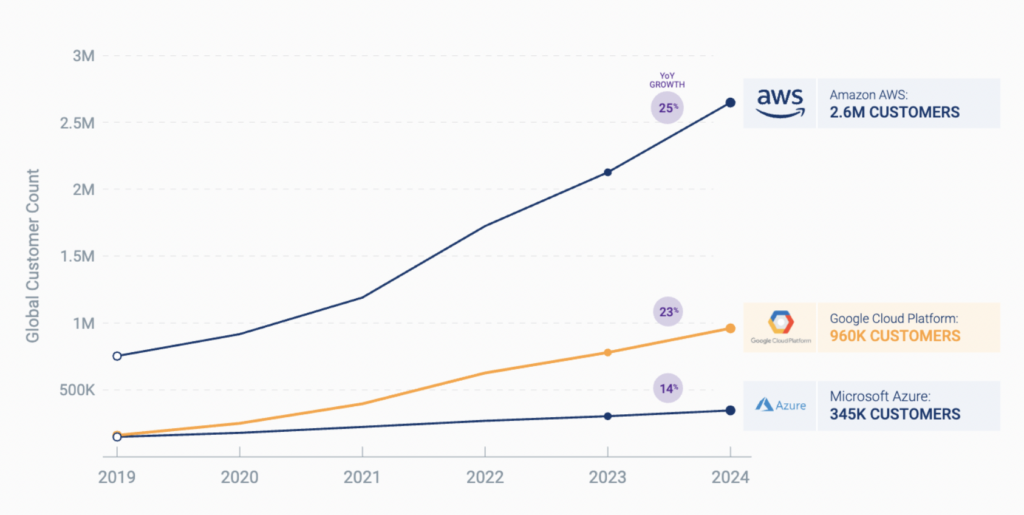

But they have also important differences. AWS is exhaustive and target both large enterprises and smaller ones. Azure is really focused on the enterprise segment and GCP provides a strong developer experience and is recognized for its machine learning and data processing capabilities. As you can see on the below chart, this is perfectly reflected. Azure has less customers but they are enterprise and pay more than AWS and GCP.

China – Alibaba cloud, Huawei & Tencent

China is the third largest cloud computing market after the US and Europe. The US dominance stems from a high concentration of large enterprises, a mature technology ecosystem, and the presence of leading cloud providers like AWS, Microsoft Azure, and Google Cloud Platform (GCP).

European market is rapidly expanding and has strong regional players such as OvhCloud, Hetzner or Scaleway but most companies still use americans Hyperscalers .

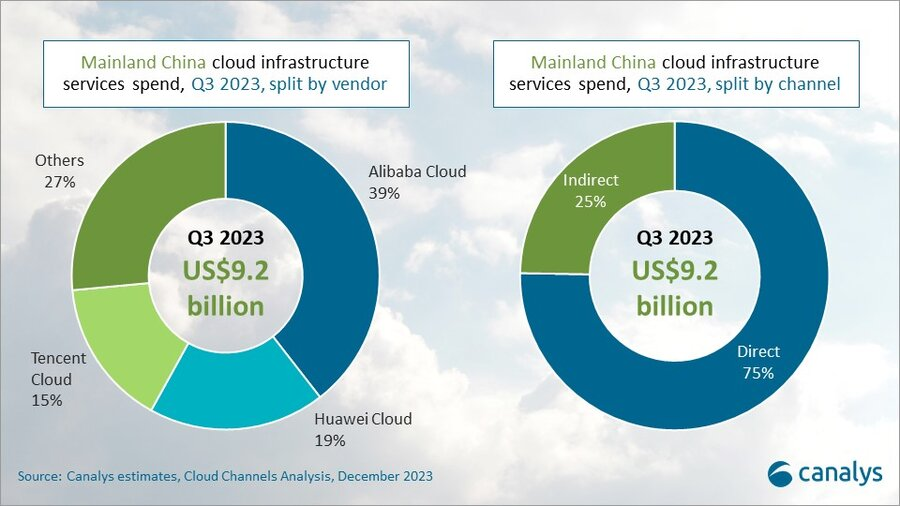

In China, everything is different as companies are using mostly Chinese cloud providers. According to Canalys, Alibaba has 39% market share in China, Huawei Cloud 19% and Tencent 15%.

Alibaba is currently ranked as the 4th biggest cloud provider worldwide.

Chinese cloud providers are now targeting to expand in Europe, Asia and emerging countries.

Nvidia figures reflects the AI cloud market growth

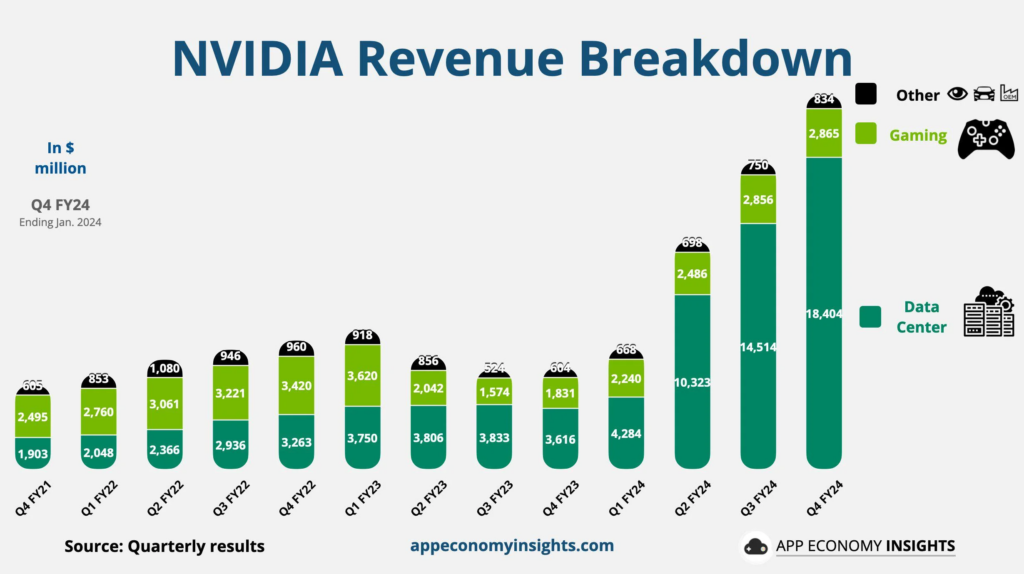

The hyperscaler giants (Amazon Web Services, Microsoft Azure, and Google Cloud Platform) witnessed a period of tempered quarterly growth in 2022 and 2023. However, the emergence of generative AI has significantly shifted the momentum. These powerful AI tools require substantial computing resources, propelling a renewed surge in cloud adoption by hyperscalers.

Nvidia, the leading manufacturer of Graphics Processing Units (GPUs), stands at the forefront of this AI revolution. GPUs are particularly well-suited for handling the complex calculations required by generative AI models. As a result, Nvidia has experienced a dramatic increase in demand for its datacenter-focused GPUs.

The provided graph below, visually illustrates this remarkable growth. Between Q1 2024 and Q4 2024, Nvidia’s data center GPU revenue has skyrocketed more than fourfold, reaching a staggering $18 billion. This surge highlights the critical role Nvidia plays in enabling the advancements in generative AI and the hyperscalers’ ability to capitalize on this transformative technology.

After the Hyperscalers come Alternative cloud providers

The rest of the cloud market pie (25%) after the Hyperscalers is shared among alternative vendors. Oracle cloud Infrastructure (OCI) is the leader in this category and is experiencing significant growth (49% in Q3 2024). Then comes many smaller/regional alternative vendors such as OVHCloud, DigitalOcean, Hetzner, Scaleway, Akamai/Linode, Vultr…. If you want to learn more about them (revenue, service and regional coverage) we have made a benchmark comparing the top cloud providers in 2024.

Another interesting trend is the rise of AI provider such as Coreweave, Lambda labs that have raised lots of cash in 2024.

Wrap up

The cloud computing market is experiencing a growth surge, fueled in part by the rise of generative AI. Cloud spending soared in 2023, and this momentum continued in 2024 with strong growth from major providers like AWS, Azure, and GCP. Generative AI, with its massive computing needs, is a key driver. By 2025, traditional IT spending is predicted to be eclipsed by cloud spending.

The market is dominated by three titans: AWS, Azure, and GCP. While AWS remains the leader, Azure and GCP have shown impressive growth, doubling their market share in recent years. Azure leverages its enterprise network, while GCP shines in machine learning and AI. The rise of AI puts a question mark on AWS’s future dominance, as both Azure and GCP have made significant AI investments.

The cloud market’s future is bright, with AI acting as a major growth engine. Cloud adoption is accelerating, making it a central pillar of enterprise IT strategies. The battle for market share among hyperscalers, especially in the AI realm, is likely to intensify. Additionally, regional variations in cloud market dynamics will continue to be a factor to watch.

Given the high costs associated with cloud services, optimizing cloud spending is a top priority for many businesses. Cloud cost management tools such as Holori can help businesses visualize and optimize their cloud expenditures, leading to significant cost savings.

Ready to optimize your cloud spending? Start your free 14-day trial with Holori today : https://app.holori.com/