Long in the shadow of the hyperscalers, Oracle Cloud Infrastructure (OCI) has matured into a strategic cloud platform. It is now targeting enterprises running mission-critical workloads, data platforms, and regulated systems. But as OCI adoption accelerates, so does cloud spend complexity. In 2026, OCI cost optimization is no longer about accessing billing data, it is about making that data usable. This article provides an in-depth benchmark of the best OCI cost optimization tools in 2026. It covers both native OCI cost management tools and third-party FinOps platforms.

OCI is now a key challenger of the hyperscalers. However its third-party software ecosystem was a bit limited for some time. It’s not the case in 2026 anymore, especially for FinOps, let’s discover which solution is best for you!

Why OCI Cost Optimization Matters More Than Ever in 2026

OCI has always positioned itself as a high-performance, cost-competitive alternative to hyperscalers. However, the reality in 2026 is that OCI environments are no longer simple.

Several trends are driving the need for advanced OCI cost optimization:

- Increased service diversity: OCI now spans across numerous services. Compute, OKE, databases, AI infrastructure, analytics, and SaaS-like managed services, each with different billing behaviors.

- Enterprise-scale tenancy structures: Multi-compartment, multi-region, and multi-tenancy OCI architectures make manual cost tracking impossible.

- FinOps accountability: Business units, product teams, and application owners are increasingly expected to own their cloud P&L.

- Predictability pressure: CFOs expect reliable forecasts, not end-of-month surprises, even in elastic environments.

- Hybrid and multi-cloud strategies: OCI rarely exists alone. FinOps teams must normalize OCI costs alongside AWS, Azure, or GCP in addition to new usage such as AI.

In this context, OCI cost optimization in 2026 is about more than savings. It is about speed, clarity, accountability, and decision support.

Key Areas for OCI Cost Optimization in 2026

Modern FinOps teams focus on several optimization pillars when managing OCI spend:

1. Cost Visibility and Allocation

Understanding where OCI spend comes from: by compartment, project, team, or application. This includes consistent tagging, allocation rules, and cost normalization.

2. Budgeting and Forecasting

Static budgets are no longer sufficient. Teams need rolling forecasts, scenario modeling, and early alerts to manage growth without friction.

3. Resource Optimization

Idle compute, oversized shapes, unused block volumes, and inefficient OKE clusters remain major cost drivers in OCI environments.

4. Governance and Accountability

Policy enforcement, budget ownership, and guardrails ensure teams optimize continuously rather than reactively.

5. Reserved Capacity & Committed Use

Managing the lifecycle of OCI Compute Reservations.

Native OCI Cost Management Tools vs Third-Party FinOps Platforms

Before reviewing individual solutions, it is important to understand how native Google Cloud tools differ from external platforms.

| Category | Native GCP Tools | Third-Party Tools (e.g, Holori) |

| Integration | Natively part of OCI console. No extra configuration needed. | Requires cloud account connection; usually one-time (easy) setup with read-only access |

| Cost | Part of OCI monthly bill. | Subscription-based, usually percentage of cloud spend or tiered pricing structure |

| Coverage | OCI only and limited scope | Wide reach, multi-cloud, Kubernetes, specialized services, AI infrastructure, and third-party integrations |

| Depth of analysis | Basic utilization metrics and elementary recommendations | Complex analytics featuring ML-powered insights, anomaly detection, AI cost monitoring, and business context |

| Automation | Limited, mostly manual actions. | Automated actions: cost allocation, rightsizing, resource scheduling, etc. |

| Kubernetes cost monitoring and optimization | Limited, indirect | Advanced Kubernetes cost monitoring, deep optimization options |

| Optimization automation | Recommendations only | Automation, alerts, workflows |

| UX | Multiple tools, lack of coherence between them. | UX designed around FinOps constraints to maximize efficiency |

| Support | Limited to OCI standard support level (depending on your agreement). | Dedicated cost optimization expertise and implementation support |

| AI Workload Visibility | Entry level GPU and AI service monitoring | Purpose-built AI cost tracking with token-granular visibility and utilization analytics (limited to what’s available in the billing export) |

| Best for | Organizations with modest OCI footprints (<$5K/month) and elementary requirements | Expanding organizations pursuing deeper savings, automation, AI cost governance, and cross-functional collaboration |

Deep Dive: The Best OCI Cost Optimization Tools in 2026

1. Holori

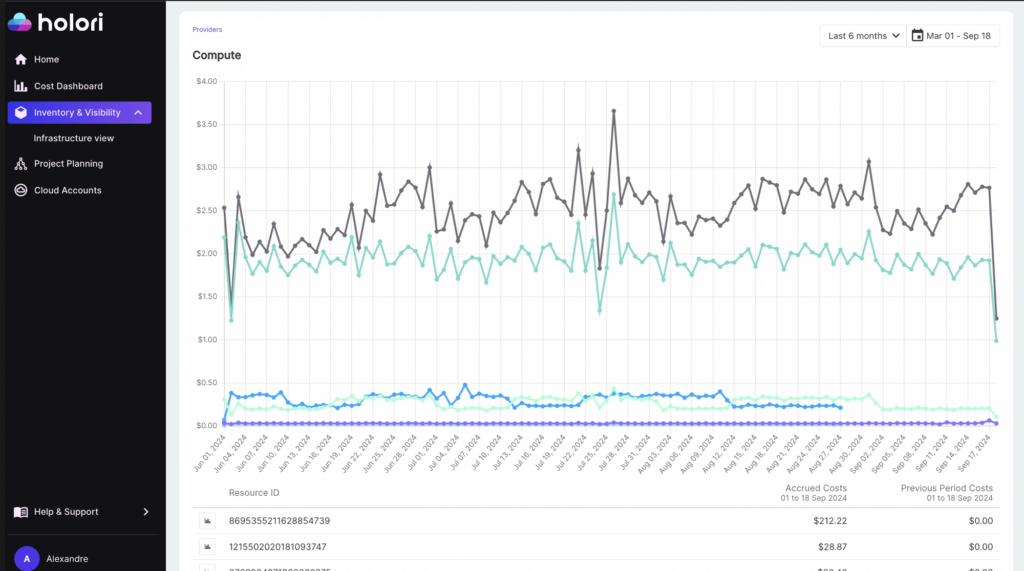

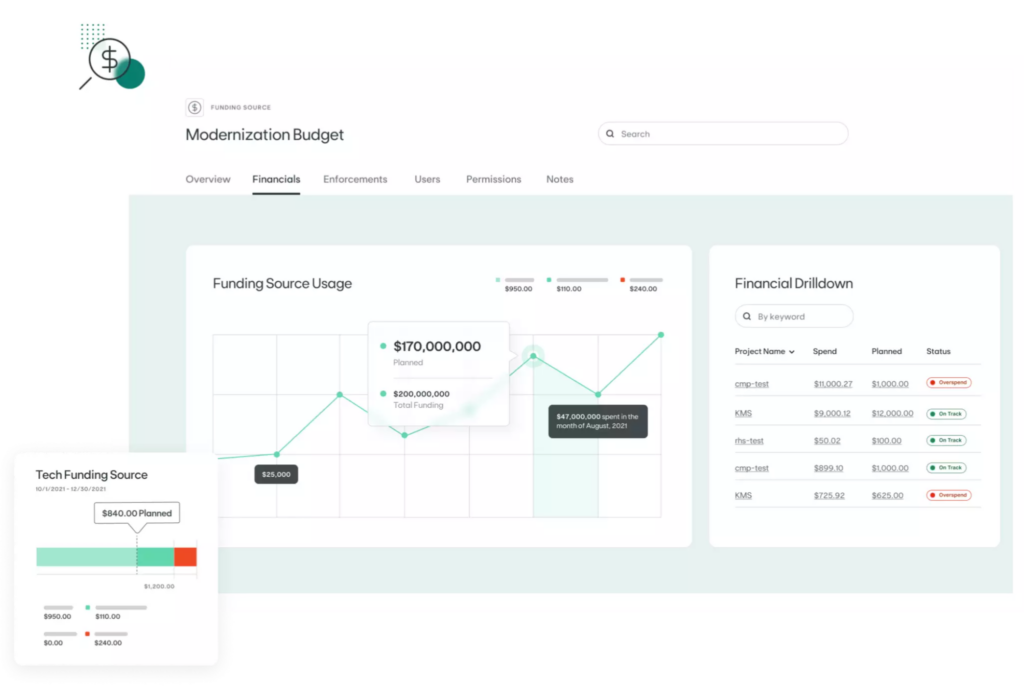

Holori is a modern FinOps platform for Oracle Cloud Infrastructure (OCI) environments. It is particularly appealing to those seeking immediate results without the burden of complex tooling. Holori delivers deep OCI cost visibility through a clean, intuitive interface that simplifies billing complexity without sacrificing detail. Its core capabilities include real-time cost tracking by resource, compartment, project, and team. It is capable of advanced cost allocation thanks to tagging normalization using virtual tags. Moreover, its visual cost allocation interface makes it extremely easy. Its anomaly detection algorithm ensures that no unexpected variation stays hidden. Also, it provides actionable optimization recommendations for compute, storage, and unused resources.

Holori excels in scenarios requiring rapid cost visibility for OCI environments, alongside other providers. It is ideal for teams frustrated by heavyweight tools, and companies scaling OCI usage without dedicated FinOps engineers. While Holori is less policy-heavy than governance-first platforms, its focus on actionable insights and speed to value sets it apart. In 2026, Holori plans to introduce deeper OCI service-level optimization recommendations and push further its integration with the provider.

2. OCI FinOps Hub

FinOps Hub is OCI native cost tracking tool. It, of course, integrates seamlessly with OCI’s ecosystem, providing a unified interface for tracking and managing cloud spend. The platform offers centralized cost dashboards that allow teams to monitor expenditures at the compartment level. This ensures that financial oversight aligns with organizational structure and access controls. Basic usage trend analysis is also available, helping teams identify spending patterns over time.

OCI FinOps Hub is well-suited for organizations that run fully on OCI and require a single view of their cloud costs. It is also a strong fit for compliance-driven environments where adherence to internal policies and external regulations is critical. However, the tool’s capabilities are somewhat limited when it comes to advanced forecasting or proactive optimization intelligence. Additionally, it lacks the ability to provide visibility across multiple cloud providers, which can be a drawback for multi-cloud environments.

Looking to 2026, OCI FinOps Hub is expected to expand its reporting depth and introduce new features aimed at enhancing user experience and analytical capabilities. Nevertheless, it is likely to remain a reactive tool rather than a proactive one, focusing more on providing historical data and basic alerts than on driving cost optimization or predictive insights.

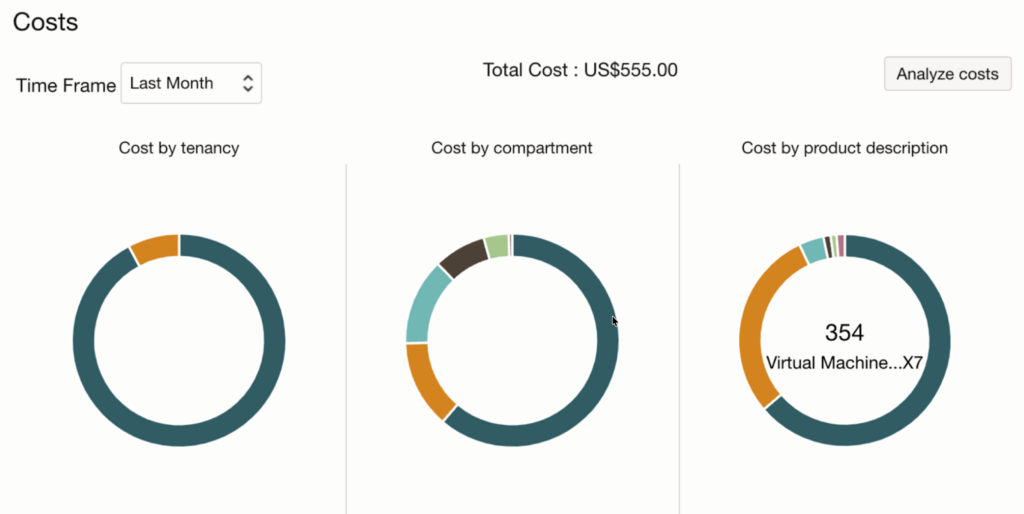

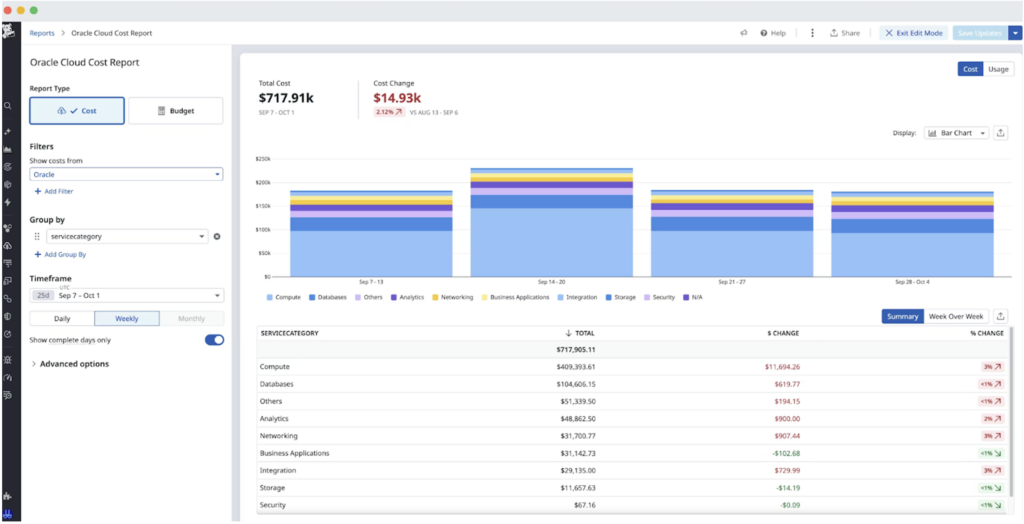

3.OCI Cost Analysis (Native OCI Tool)

OCI Cost Analysis is the basic reporting layer for Oracle Cloud Infrastructure billing, offering users a detailed and granular view of their cloud expenditures. The tool provides comprehensive cost breakdowns by service and compartment, enabling teams to understand exactly where their cloud budget is being allocated. Historical cost views allow for retrospective analysis, helping organizations track spending trends and identify areas for potential savings. Additionally, the ability to export cost reports ensures that financial data can be easily shared with stakeholders or integrated into broader financial management systems.

One of the primary strengths of OCI Cost Analysis is its immediate availability to all OCI users, with no additional cost or complex setup required. The tool delivers accurate, raw billing data directly from the source, ensuring that users have access to reliable and up-to-date financial information. However, the platform does have its limitations. It lacks predictive forecasting capabilities, meaning users cannot easily project future spending based on current trends. Similarly, it does not offer optimization recommendations, leaving the interpretation of cost data and the identification of savings opportunities largely up to the user.

The tool provides a straightforward and cost-effective way to monitor expenditures and maintain financial oversight. However, organizations with more complex FinOps needs may find the platform’s lack of advanced features to be a significant constraint.

4. OCI Budgets (Native OCI Tool)

OCI Budgets focuses primarily on spend control and financial governance. The platform allows users to set budget thresholds for individual compartments or broader organizational units, ensuring that spending remains within predefined limits. Alerting capabilities are built into the tool, with notifications sent via email or OCI events whenever budget thresholds are approached or exceeded. This feature is particularly valuable for preventing runaway spend and enforcing basic financial guardrails across the organization.

While OCI Budgets is effective at providing a mechanism for spend control, it is not designed to offer deeper cost optimization insights. The tool’s budgeting approach is static, meaning that thresholds must be manually adjusted as needs or circumstances change. Additionally, the platform does not provide context around optimization opportunities or proactive recommendations for reducing costs. Alerts generated by OCI Budgets are reactive, triggered only after spending has already occurred, rather than offering predictive insights that could help prevent overspending before it happens.

5. Datadog

Datadog has long been recognized as a leader in cloud observability. It also offers cloud cost management capabilities developed in tandem with its core monitoring and analytics offerings. The platform stands out for its ability to correlate cost data with performance metrics, providing engineering teams with a holistic view of their cloud expenditures in the context of system health and efficiency. Datadog’s dashboards are designed with engineers in mind, offering intuitive visualizations and actionable insights that align with technical workflows. Additionally, the platform excels in providing visibility into Kubernetes costs, making it a strong choice for organizations leveraging containerized workloads.

While Datadog’s cost management features are robust, they are not as FinOps-centric as those offered by specialized tools. The platform’s primary focus remains on observability, and its cost management capabilities are best viewed as an extension of this core functionality. As a result, organizations seeking a dedicated FinOps solution may find Datadog’s offerings to be somewhat limited in scope. Furthermore, while Datadog’s support for Oracle Cloud Infrastructure is improving, it is not yet as comprehensive as its support for other major cloud providers like AWS and Azure.

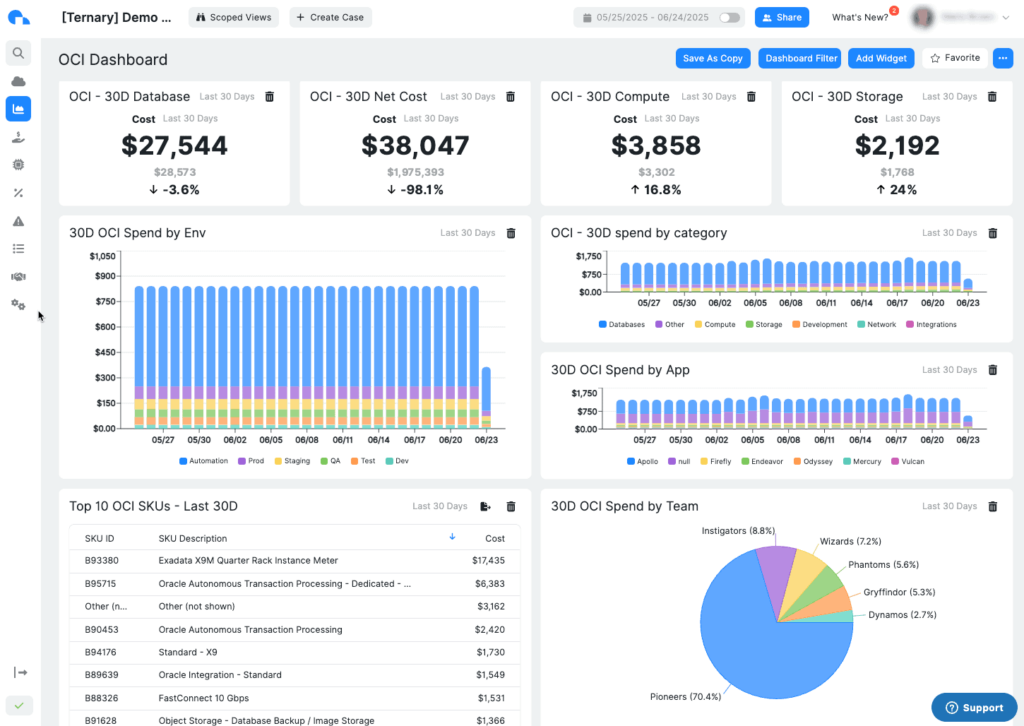

6. Ternary

Ternary is a Kubernetes-first FinOps platform, excelling in deep cost allocation for containerized workloads, team-based chargeback, and engineering-native workflows. It is particularly well-suited for organizations using Oracle Kubernetes Engine (OKE) or other container orchestration platforms.

The platform’s core value lies in its ability to deliver deep cost allocation at the container and pod level, enabling teams to understand exactly how their Kubernetes resources are being consumed and where costs are being incurred. Ternary also supports team-based chargeback models, allowing organizations to attribute costs to specific teams or projects and foster a culture of cost accountability.

While Ternary’s focus on Kubernetes cost management is a significant strength, it also represents a limitation for organizations with broader FinOps needs. The platform’s capabilities outside of containerized environments are narrower, and its forecasting features for non-Kubernetes OCI services are less mature than those offered by more generalist FinOps tools. As a result, Ternary may not be the best choice for organizations seeking a comprehensive cost management solution that spans their entire cloud infrastructure.

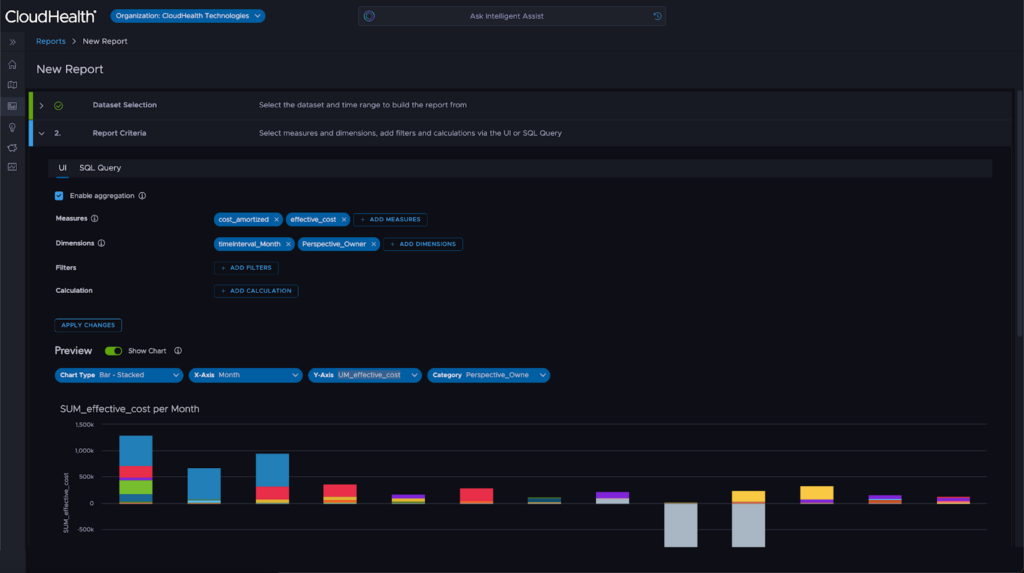

7. CloudHealth (VMware)

CloudHealth by VMware remains one of the most established and widely adopted FinOps platforms in 2026, particularly among large enterprises with complex cloud environments. The platform enables organizations to enforce policies, manage compliance, and maintain financial control across their cloud assets. The platform also offers robust enterprise reporting capabilities, making it easier for teams to generate the financial insights and KPIs needed for executive decision-making.

Despite its many strengths, CloudHealth is not without its challenges. The platform is known for its long implementation cycles, which can be a significant barrier for organizations looking to quickly deploy a FinOps solution. Additionally, the user experience can be complex and overwhelming, particularly for teams that lack dedicated FinOps expertise. This complexity can also contribute to a slower time to value, as organizations may need to invest considerable time and resources in configuring the platform to meet their specific needs.

CloudHealth is best suited for large enterprises with mature FinOps teams and a need for comprehensive governance and multi-cloud cost management. However, smaller teams or those seeking a more agile and user-friendly FinOps solution may find CloudHealth’s complexity, implementation requirements and cost to be prohibitive.

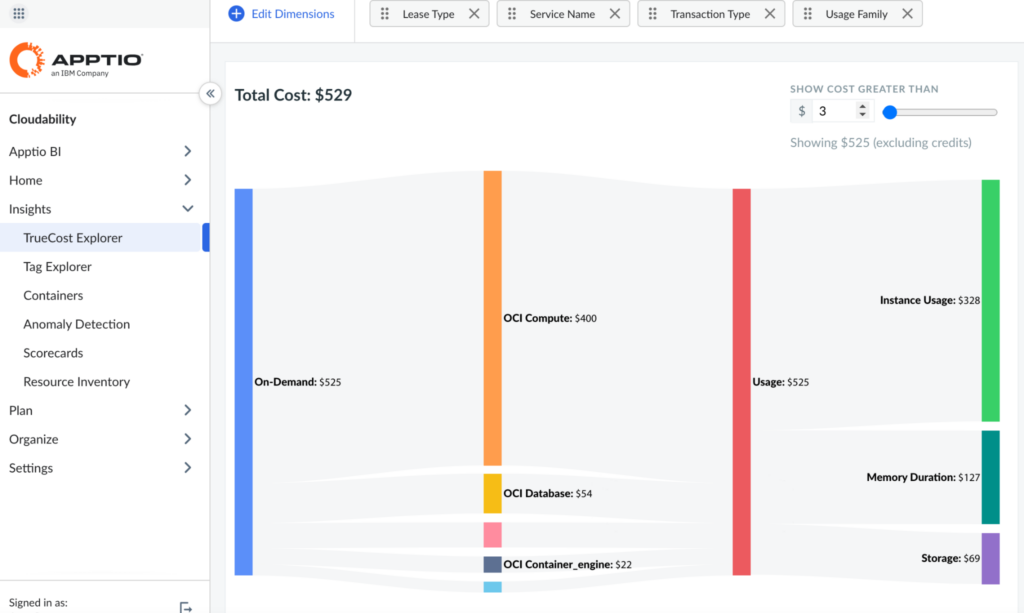

8. Cloudability (Apptio)

Cloudability, part of the Apptio suite, continues to be a reference platform for enterprise FinOps in 2026. It offers a comprehensive set of features designed to support formal FinOps operating models. The platform excels in providing detailed cost allocation and chargeback models, enabling organizations to attribute cloud expenditures to specific departments, projects, or business units. Strong tagging governance and policy enforcement capabilities ensure that cost data is accurately categorized and aligned with internal financial processes. Cloudability also offers robust budgeting and forecasting tools, allowing teams to project future spending and identify potential cost overruns before they occur.

Cloudability’s enterprise-grade capabilities come with certain trade-offs. The platform is known for its long onboarding and configuration cycles, which can delay time to value and require significant upfront investment. Additionally, Cloudability’s complex user experience and requirement for dedicated FinOps expertise may make it less accessible to smaller teams or those without specialized financial operations resources.

9. Kion

Kion is a governance-first FinOps platform that integrates cost management with security and compliance controls. It offers policy-driven budget enforcement, role-based access workflows, and cost visibility tied to compliance requirements. Kion is particularly well-suited for regulated industries, such as healthcare, finance, and the public sector, where strict financial and operational controls are essential. The platform is also a strong fit for organizations that prioritize governance and compliance over flexibility and agility, as well as teams with centralized cloud management structures.

However, Kion’s focus on control and oversight can be a double-edged sword. The platform is less flexible for agile engineering teams that require rapid iteration and experimentation, and its optimization insights are secondary to its core governance capabilities. As a result, Kion may not be the best choice for organizations seeking a FinOps solution that prioritizes cost optimization and engineering empowerment.

10. Finout

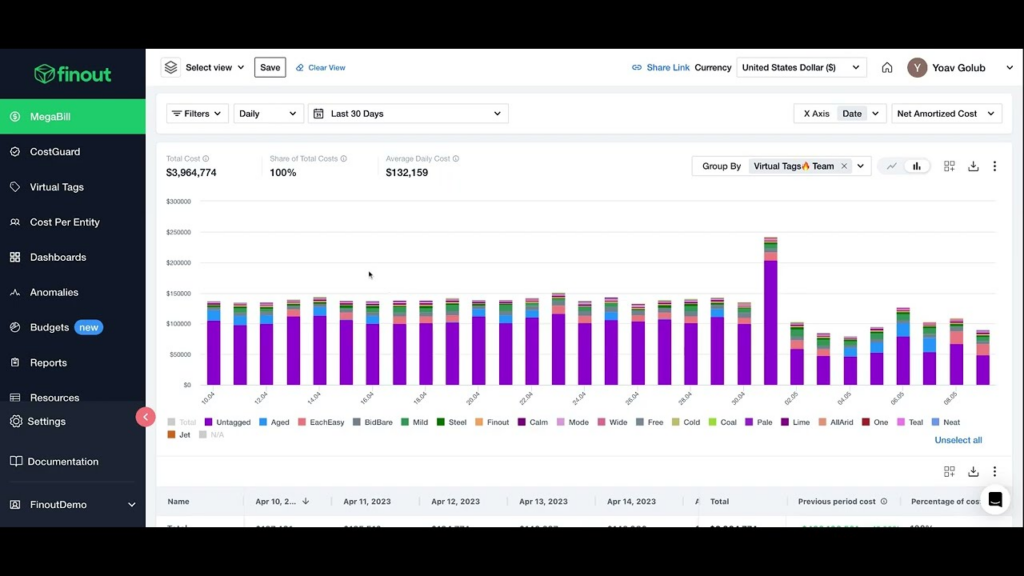

Finout is a modern, engineering-friendly FinOps platform with a strong emphasis on data normalization, unit economics, and feature-level cost tracking. A standout feature is MegaBill, which consolidates all cloud services into a single view. This provides real-time insights into total cloud spending across various infrastructure services. The platform enables organizations to allocate costs across shared services and track expenditures at the feature or product level, providing a granular view of where and how cloud resources are being consumed. Finout’s near real-time cost visibility ensures that teams have access to up-to-date financial data, allowing them to make timely and informed decisions. Additionally, the platform offers robust support for containerized workloads, making it a strong choice for organizations leveraging Kubernetes and other modern cloud-native technologies.

Finout is particularly well-suited for SaaS companies and product-led organizations that prioritize understanding the cost drivers behind their features and services. The platform’s focus on unit economics and cost per feature tracking aligns closely with the needs of these teams, enabling them to optimize spending in a way that directly impacts profitability and business outcomes. However, Finout’s governance and budgeting features are less mature than those offered by more established enterprise platforms, and its forecasting capabilities are still evolving. Additionally, while Finout provides strong support for containerized environments, it is less focused on OCI-specific nuances than tools designed specifically for Oracle Cloud Infrastructure.

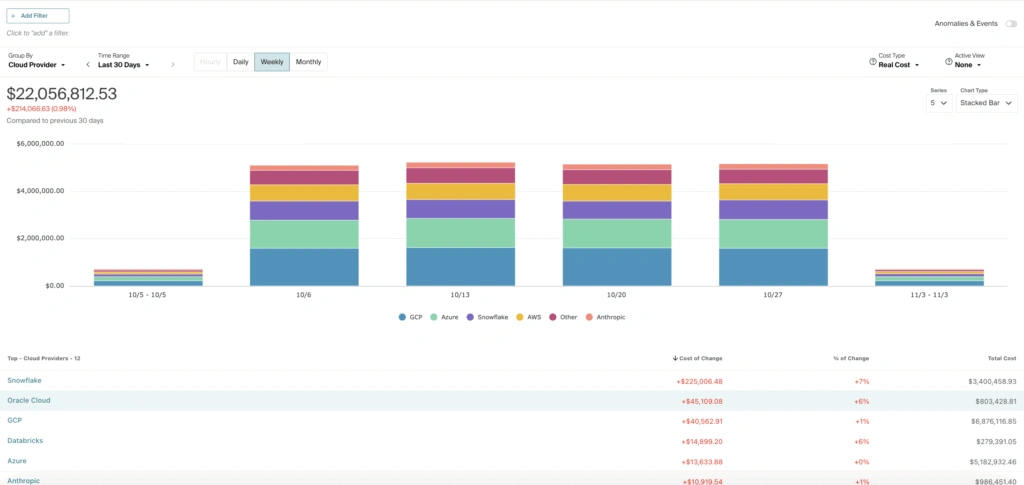

11. CloudZero

CloudZero’s is a cloud intelligence platform that automates the collection, allocation, and analysis of cloud cost data to uncover savings opportunities and improve unit economics.The tool’s ability to break down costs by customer, feature, or environment enables organizations to understand the financial impact of their technical decisions in a granular and actionable way. CloudZero’s strong unit economics analysis helps teams connect cloud expenditures to business outcomes, such as customer acquisition costs or feature profitability. The platform’s engineering-aligned dashboards are designed to integrate seamlessly with technical workflows, ensuring that cost data is accessible and relevant to the teams that drive cloud consumption.

While CloudZero excels in cost intelligence, it is less governance-oriented than some enterprise platforms, and its budgeting features are secondary. The platform’s OCI support is improving, but remains less comprehensive than its support for AWS or Azure for example. In 2026, CloudZero is expected to expand its OCI coverage and introduce more advanced forecasting and automation features.

What’s Changing in 2026?

On the FinOps side, OCI users are demanding simplicity. Modern tools are ditching the complex setups of legacy players for smooth, near-instant onboarding. In 2026, the goal is to spend less time configuring tools and more time optimizing architecture.

AI is the new cost frontier. With the explosion of OCI’s GPU clusters and AI services, costs are scaling faster than ever. Precision tracking is now vital; FinOps tools must integrate these heavy AI compute costs, often spread across multiple OCI regions and third-party AI models, into a single, transparent view.

But cost is only half the story. The environmental toll of running massive AI models is now a growing concern. We can bet that in 2026 GreenOps will move from a “nice-to-have” to a core requirement. Most tools let it aside but GreenOps aspects are likely to become a standard feature.

Conclusion: Which of the best OCI cost optimization tools should you choose?

After many years without a real ecosystem, the OCI landscape of 2026 is more dynamic than ever before. While native tools like the OCI FinOps Hub provide a necessary foundation, the complexity of modern cloud architecture demands specialized third-party platforms. Those bring deeper insights, forecasting, and optimization capabilities, but they vary widely in complexity and time to value. Heavyweight enterprise tools like CloudHealth, Cloudability, and Flexera offer strong governance but often struggle with adoption speed and usability. Modern platforms such as Finout, CloudZero, Vantage, and Ternary are a good fit to engineering-driven organizations but may lack holistic OCI-first depth.

Holori distinguishes itself by focusing on what FinOps teams need most in 2026: Fast onboarding, immediate OCI cost visibility, actionable insights without complexity, a user experience accessible to both finance and DevOps.

Holori therefore represents a compelling balance between power and simplicity, making it one of the best OCI cost optimization tools in 2026.

Ready to give it a try, go to https://app.holori.com