Following the pandemic that accelerated the adoption of cloud computing over the last 2 years, we can see that the figures keep growing and that the crisis was more a long-term booster for the cloud market rather than a short-term effect.

In a recent article we wrote that companies that adopted cloud in the recent years increased their usage and are now increasingly shifting towards multicloud strategies. The Flexera State of the cloud 2022 report as also shown that companies are investing more and more money and that new concerns are emerging from the use of these technologies such as security, multicloud-management, Kubernetes adoption.

The amounts at stake being always more important, it becomes critical for companies to better understand and optimize the use of resources. At a global scale, companies are investing heavily. According to Gartner, global public cloud spending is forecast to reach $474 billion in 2022, up from $408 billion in 2021.

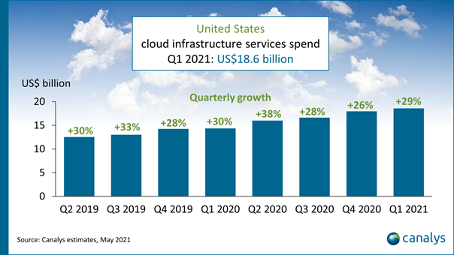

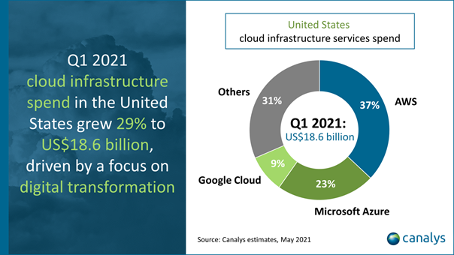

American cloud market

It’s no surprise that the US cloud market is the largest one by far and represents 44% of total spend. You can see on the above chart significant growth spikes (38%) during covid crisis and more recently a growth of 29% in Q1 2021 to reach a record of $18,6B.

The market share of leading cloud providers remain the same: AWS with 37%, Azure with 23% and GCP with 9%. AWS, Azure and Google Cloud have plans to open new datacenters in the US in 2021 to keep their leadership. For example Microsoft Azure opened Georgia and Arizona in 2021 and will keep increasing this number as they recently announced to build 50 to 100 new datacenters each year worldwide.

Besides tech giants, there are other players to consider: Linode and Digital Ocean. Linode got acquired by Akamai in 2022 and is here to stay with more resources to increase its market share. OVH, another cloud provider, based in Europe, recently announced that its turnover increased by 106% on the US market.

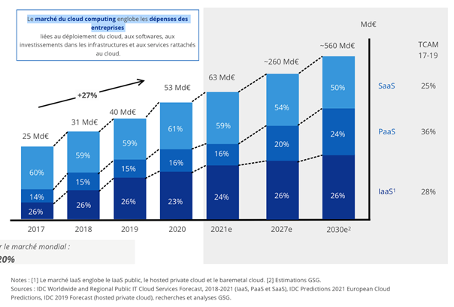

European Cloud Market

The European cloud market has also grown more during Covid time but it is only the third market after US and China.

The European market has national cloud providers such as Deutsche Telekom, OVH, Scaleway, Orange and different national telcos. Those providers are fighting against the world leading cloud providers: AWS, Azure, GCP who accounts for 66% of the market whereas 3 years ago, they accounted for only half of it.

“European cloud providers are trying to gain more traction in the market by focusing on customer segments and use cases that have stricter data sovereignty and privacy requirements. This has led to the Gaia-X initiative which represents an attempt to reverse the fortunes of the European cloud industry,” said John Dinsdale, a chief analyst at Synergy Research Group.

Despite its delay compared to the other major regions, the European cloud market is expected to grow very strongly in the coming years with new datacenters popping up across the continent.

Different scenarios forecast the European market to reach more than 300B$ by 2030 which equals to the current market size worldwide.

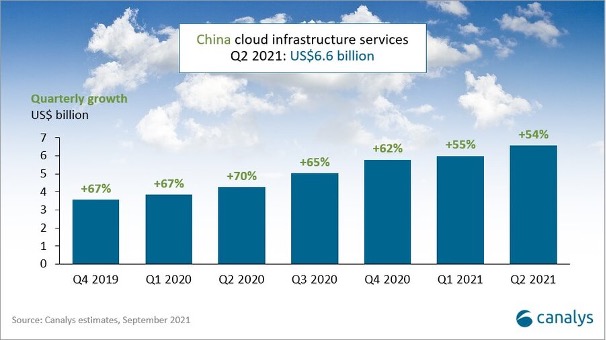

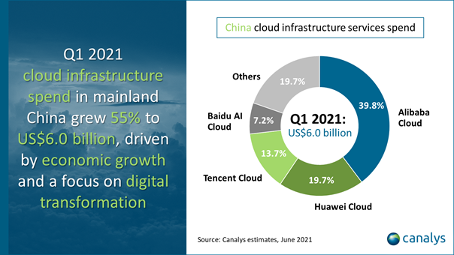

Chinese cloud market

The Chinese cloud market continues to outpace the rest of the world with an average growth that is twice more important than in the US (60 vs 30%). In Q2 2021 China’s cloud infrastructure spend exceeded 6B$ which accounts for 14% of the worldwide cloud market.

As on the other market regions, the pandemic has accelerated the growth, in Q2 2020 we can see a peak of 70% of growth. There are other underlying reasons for this fast growth:

China is the only major economy who reported economic growth for 2020 with a GDP that grew by 2,6%.

The Chinese government has made cloud computing a top priority through its “internet plus” Strategy in 2015. The government is promoting and subsiding the cloud industry.

Chinese tech giant such as Alibaba, Tencent, Baidu, Huawei offer cloud solutions and can compete against their American rivals as they have an equivalent size.

The main cloud providers in the Chinese cloud market are Alibaba, Huawei Cloud, Tencent and Baidu AI Cloud, which together accounts for more than 80% of total expenditure. Laws that prioritize Chinese companies make it hard for their American competitors to enter the market.

Chinese cloud providers are now targeting to expand in Europe, Asia and emerging countries. As with the 5G network, we can expect a digital war between US and China.

Key cloud providers worldwide

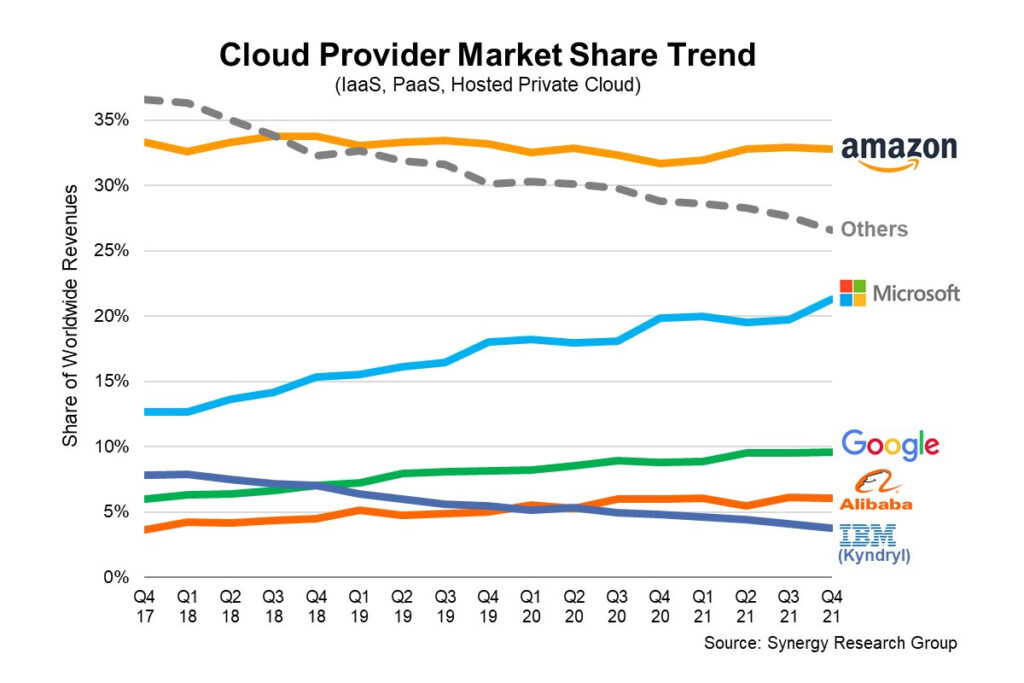

The market is dominated by 3 majors cloud providers sharing 64% of the pie. AWS is the leader with 33% of market share, Azure closely follows with 21% and Google Cloud with 10% of market share. Shortly after comes Alibaba with a little less market share than Google.

As for Q4 2021, the worldwide cloud market reached $50 billion in revenues, up 36% compared to 2020. The big three, AWS, Azure and GCP, continue to grow at a significant rate but Microsoft and Google are catching up. Both are growing at similar rates, around 45% for the quarter, while AWS is growing at just under 40%.

Azure only had a 11% market share back in 2017 and managed to double its position in a very short timeframe.

If you want to compare AWS vs Azure or GCP vs AWS, you can use Holori free cloud calculator. It compares more than 50 000 offers and helps you find your way in this cloud war.

Holori cloud calculator is accessible here: https://app.holori.com/compare

Amazon Web Services

Amazon is an interesting case as its market share have plateaued around 33% with an increasingly growing market. It means that AWS cloud revenues have kept increasing over the past years.

AWS has started the commercialization of their cloud products 11 years ago and remain market leader despite the increasing competition.

AWS is leading the technical and commercial battle. When Amazon is implementing a technology or a new business model, other follow.

AWS CEO, Jeff Bezos has said, “AWS had the unusual advantage of a seven-year head start before facing like-minded competition. As a result, the AWS services are by far the most evolved and most functionality-rich.”

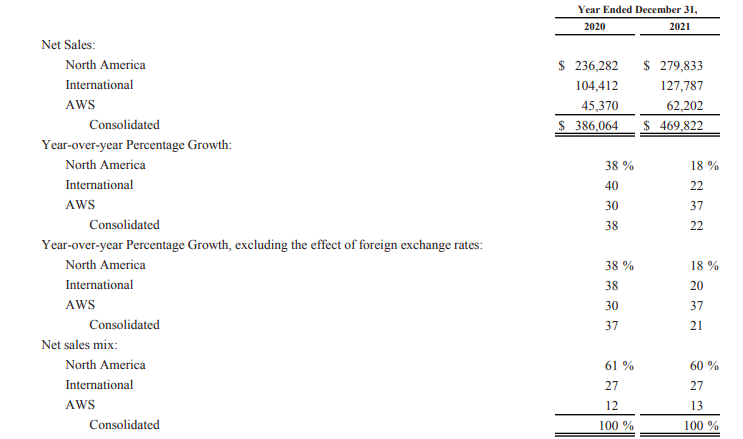

In 2021 AWS reported $62B turnover with a net profit of $18.5B. It represents a 38% growth compared to last year turnover.

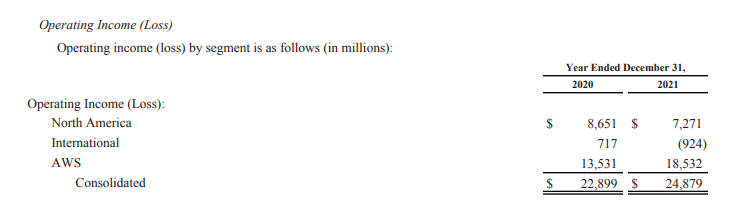

As you can see on the financial report below, Amazon, the parent company, announced a $280B revenue on the same year. Since the operational margin is very low in the e-commerce industry Amazon only reported $6B profit in 2021.

Most of the profit is generated by AWS division and the e-commerce is only the tip of the iceberg.

“On the growth rate, I think it’s a combination of things. We’ve been adding resources in sales and marketing over the last two years, and that is starting to pay off,” Brian Olsavsky, Amazon’s finance chief, said of revenue growth during a conference call with analysts.

Microsoft Azure

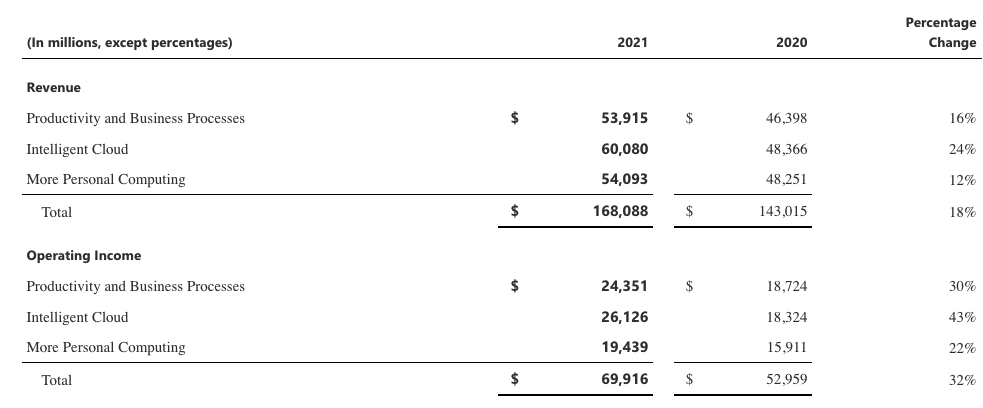

Microsoft is certainly AWS biggest rival, last year Microsoft Intelligent cloud division revenue reached 60B$ which is very close to AWS but here is the trick: this division includes many other services such as Microsoft SQL Server, Windows Server, Visual Studio, System Center, and related CALs, Microsoft Azure, and GitHub.

Compared to 2020 the revenue of the intelligent cloud division grew by 24%.

The segment was Microsoft’s largest division by revenue and by operating income $26,1 billion. It was driven by a 50% increase in revenue for Microsoft’s Azure cloud computing platform.

Microsoft CEO Satya Nadella said: “Over a year into the pandemic, digital adoption curves aren’t slowing down. They’re accelerating, and it’s just the beginning. We are building the cloud for the next decade, expanding our addressable market and innovating across every layer of the tech stack to help our customers be resilient and transform.”

Back in 2017 Azure revenue where at the same level than Google cloud. Microsoft Azure saw its revenue soar faster than its main competitor and became the second player on the market.

Microsoft Azure had impressive growing stats with growth reaching 90% in Q1 2018, 98% in Q2 2018, 93% in Q3 2018, 89% in Q4 2018, 76% in Q1 2019, 76% in Q2 2019, 73% in Q3 2019 and 64% in Q4 2019. However, the growth rate slightly reduced in the recent past years averaging 50% per quarter.

Nonetheless, it looks like Azure is closing the gap with AWS in terms of revenues.

Google Cloud

Google Cloud is the third largest cloud provider after AWS and Azure.

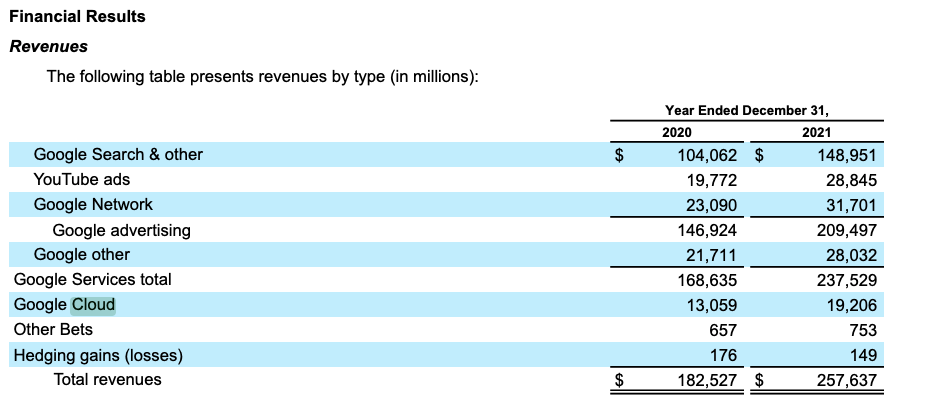

Its revenue grew from $13B in 2020 to $19B in 2021. Similar to Microsoft Azure, Google cloud division includes reviews from other sources such as Google workspace.

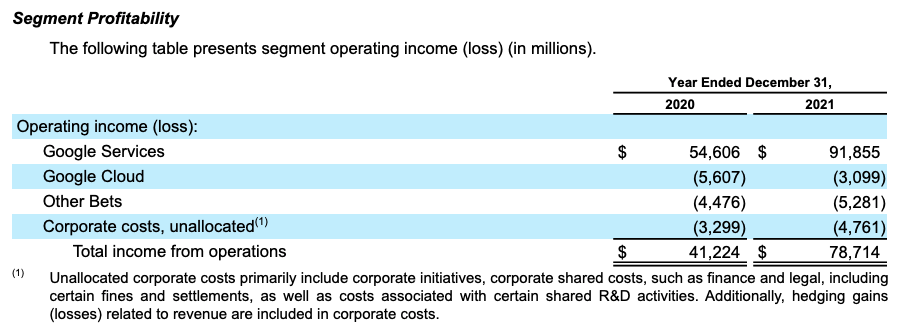

To close the gap with AWS and Azure, Google Cloud made significant investments over the previous years leading to operating loses. This was anticipated last year by Ruth Porat, Google and Alphabet CFO in the following statement: “Looking forward, we will continue to focus on revenue growth driven by ongoing investment in products and the go-to-market organization. Cloud’s operating loss reflects that we have meaningfully built out our organization ahead of revenues, as we’ve discussed in prior quarters with respect to the substantial investments in our go-to-market organization as well as engineering and technical infrastructure. Operating loss and operating margin will benefit from increased scale over time.”.

Google Cloud operating loss decreased $2.5 billion from 2020 to 2021. The decrease in operating loss was primarily driven by growth in revenues.

You can note that revenues grew by 46% and losses reduced by half.

It’s always interesting to see Companies’ revenue breakdown and identify which division generate the most profit. In 2021 Google Cloud revenue still represents 7% of google total turnover. Indeed, the turnover of other divisions also grew significantly in 2021. At the moment, Google Cloud division is the smallest in terms of revenue and doesn’t have the same impact on group profitability such as AWS or Microsoft Azure so there is plenty of room for improvement.

Alibaba Cloud

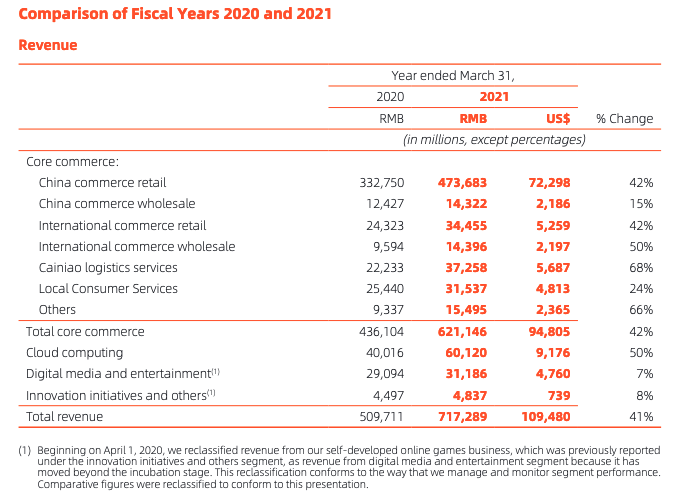

Alibaba cloud is the 4th largest cloud provider worldwide just after google Cloud with $9B revenue in 2021. After 11 years of service the Cloud division of Alibaba only became profitable in Q4 2020.

According to Canalys, Alibaba cloud has almost 40% market share on its domestic market in China but only 5% market share worldwide. The firm currently has data centers in 82 availability zones across 26 regions worldwide.

As you can see in the table below, Alibaba cloud increased its revenue by 50% between 2020 and 2021.

E-commerce remain Alibaba’s largest revenue driver in the quarter, accounting for nearly 87% of revenue, while cloud contributed 8,3%.

Alibaba may have the same pattern as Amazon with the e-commerce margins that will probably keep decreasing. Therefore, Alibaba will need to turn its cloud division into a profitable business soon. Alibaba seems to be on the right track, but competition from Tencent and Huawei could still generate new challenges.

Cloud market outlook

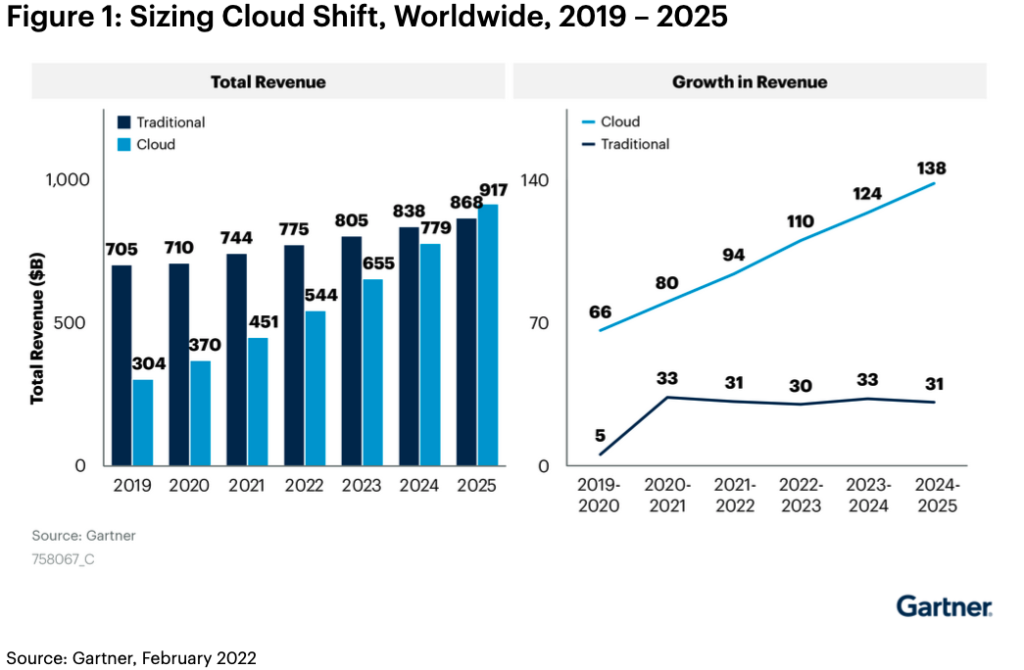

According to Gartner, enterprise IT spending on public cloud computing will overtake traditional IT spending by 2025.

As you can see from the revenue growth graph below, the revenue of traditional IT will stay level or even slightly decreased over the next years where cloud revenue will keep its sharp growth. Given the high growth rate of cloud computing, it’s expected that traditional IT spendings will become smaller than cloud spendings. For any enterprise, cloud will play an increasingly growing role in their IT strategy.