For the past several years, FinOps practitioners could walk into almost any organization, find a pile of unused Reserved Instances, oversized EC2 instances, and forgotten S3 buckets, and walk out looking like heroes. One practitioner in the survey described reaching 97% optimization in their Cost Optimization Hub — with the remaining 3% intentionally left unactioned for business reasons. That’s extraordinary, and it begs the question: what exactly is a FinOps team supposed to do next?

The answer the industry has landed on is both exciting and daunting: manage the value of all technology, not just the cost of cloud. The FinOps Foundation has even updated its official mission statement to reflect this, replacing “cloud” with “technology” across the board.

Whether your organization is ready for that expansion is a different story.

Who’s Behind the State of FinOps 2026 Report?

Before diving into the findings, it’s worth understanding who actually answered this survey because context matters a lot when interpreting industry data.

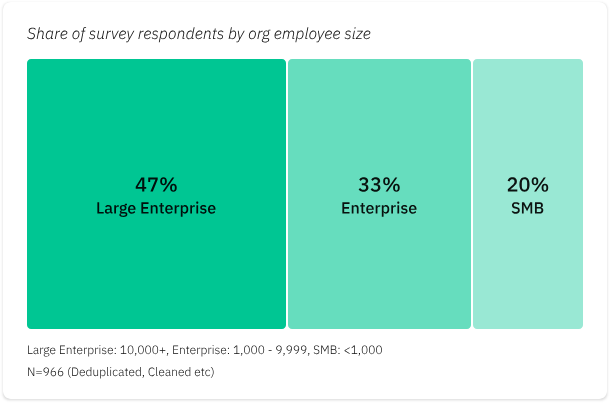

The 2026 State of FinOps is based on 966 deduplicated, cleaned responses collected by the FinOps Foundation, making it one of the most statistically significant snapshots of the FinOps community available. This isn’t a vendor-commissioned study with a narrow sample; it’s a broad practitioner survey that has been running annually since 2020.

The respondents skew enterprise. Nearly half (47%) work at large enterprises with 10,000+ employees, 33% at mid-sized organizations of 1,000–9,999 employees, and 20% at SMBs under 1,000 employees. That means the findings reflect organizations with mature, often dedicated FinOps practices — which is worth keeping in mind if you’re earlier in your journey.

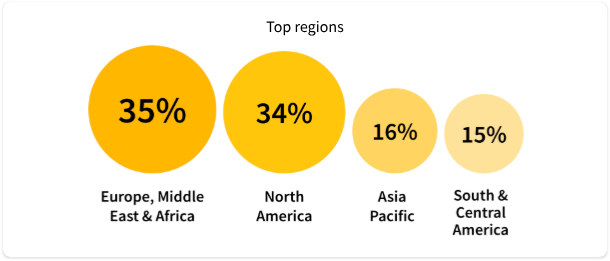

The geographic spread is genuinely global. Europe, Middle East & Africa leads at 35%, closely followed by North America at 34%, Asia Pacific at 16%, and South & Central America at 15%. This near-even split between EMEA and North America is notable — it means the data isn’t just a reflection of US cloud spending patterns, and trends like data sovereignty and multi-cloud adoption likely carry more weight here than in previous years.

In short: this is a report from practitioners who are deep in the work, at companies with real FinOps budgets and organizational structure. The challenges they’re flagging are real, the priorities they’re setting are considered, and the gaps they’re identifying are worth taking seriously.

7 Things Worth Paying Attention for FinOps in 2026

1. The AI Frenzy Is Real — and FinOps Is Caught in the Middle

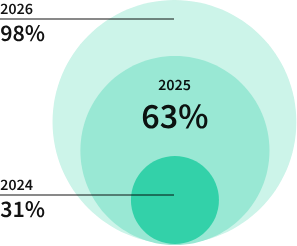

Here’s a number that should stop you in your tracks: in 2024, 31% of FinOps teams were managing AI spend. Today, that figure is 98%.

Think about that rate of change for a moment. Almost no other technology has moved from “emerging concern” to “universal responsibility” this quickly. And most teams were handed this new responsibility without a clear playbook for how to handle it.

That’s the honest reality behind the survey data. Yes, AI is the top priority. Yes, teams are investing in AI cost management skills. But when practitioners cite visibility, allocation, and ROI as their top three challenges with AI spend, what they’re really saying is: we’re managing something we don’t fully understand yet, with pricing models that are still being invented, trying to justify investments that are nearly impossible to measure.

The “is your AI providing value?” question is one the report acknowledges bluntly — and no one can really answer it yet. That’s not a criticism. It’s just where the industry is. The teams that figure out how to answer it first will have a significant advantage.

2. The Scope Explosion Is Leadership-Driven — Whether Teams Are Ready or Not

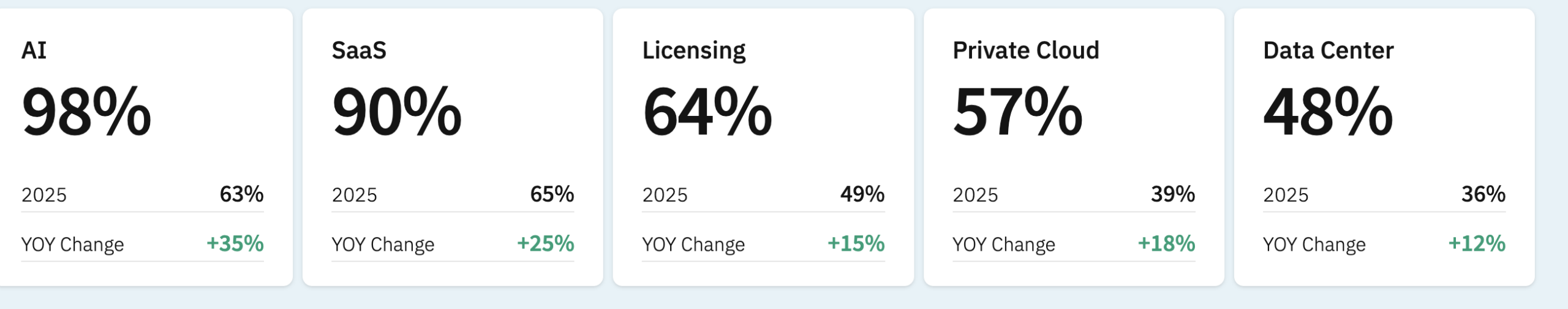

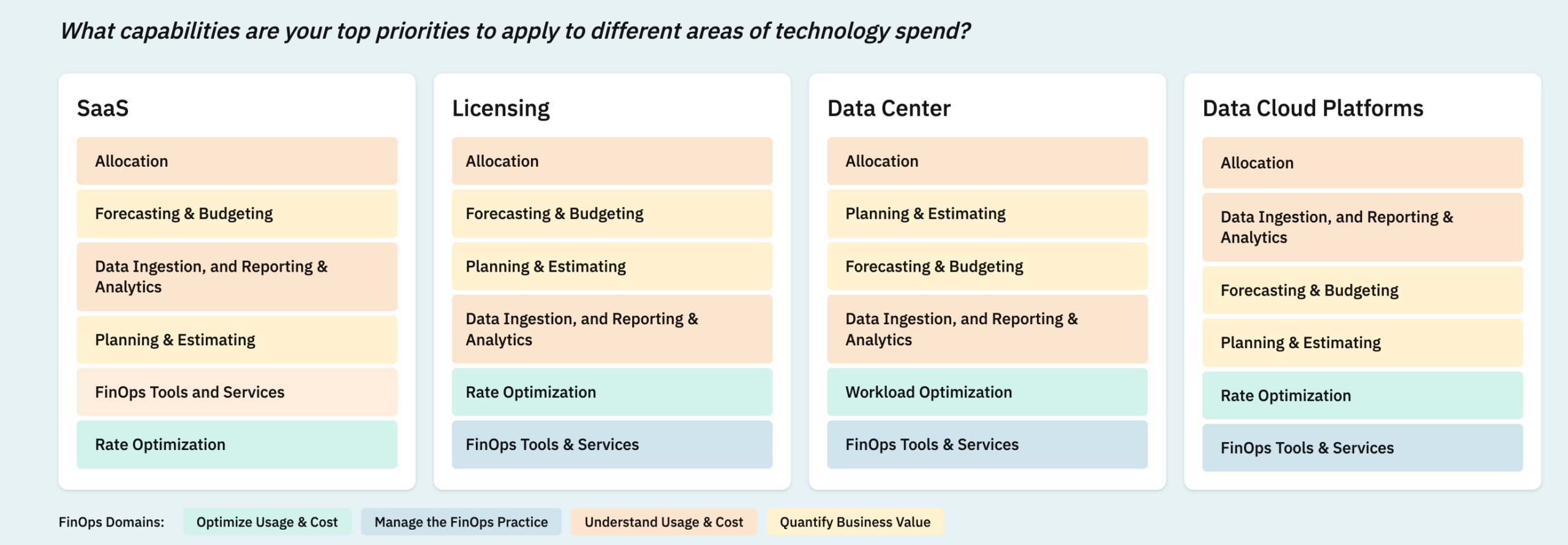

90% of FinOps teams now manage SaaS. 64% manage licensing. 57% manage private cloud. 48% manage data centers. One practitioner described it this way: “First they asked us to fix cloud. Then fix the software mess. Now it’s fix the contract and license mess, now fix the data center…”

That quote captures something the statistics alone don’t: this expansion often isn’t something FinOps teams chose. It was handed to them. Leadership sees a team that successfully brought cloud costs under control and assumes — not unreasonably — that the same approach should work everywhere else.

The challenge is that cloud FinOps took years to mature. The tooling, the best practices, the community knowledge — it accumulated over a decade. Now teams are being asked to apply that maturity to SaaS, licensing, and data centers simultaneously, often without equivalent tooling support or established frameworks.

It will work eventually. But there will be growing pains.

3. Optimization Isn’t Dead — It Just Isn’t Enough Anymore

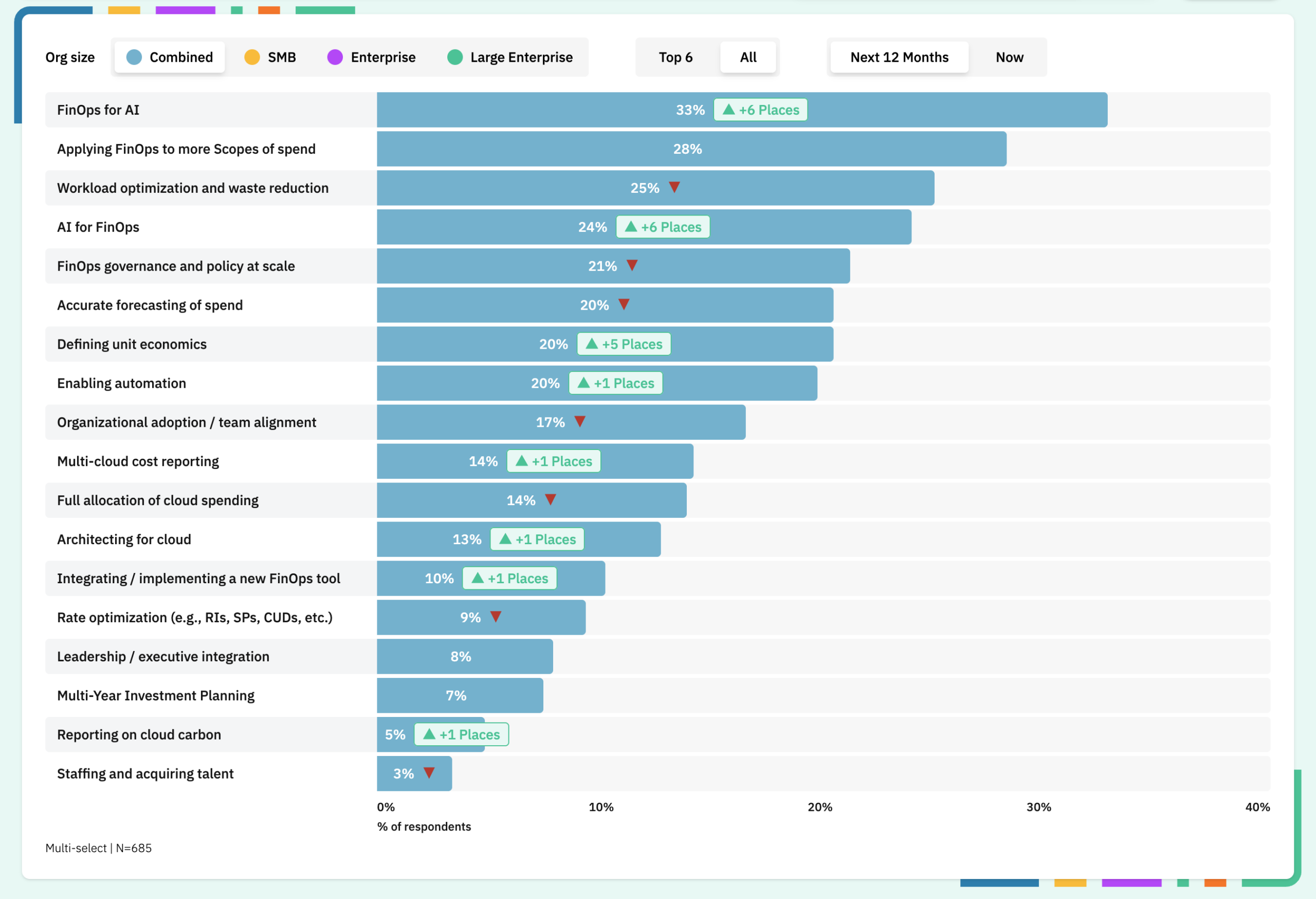

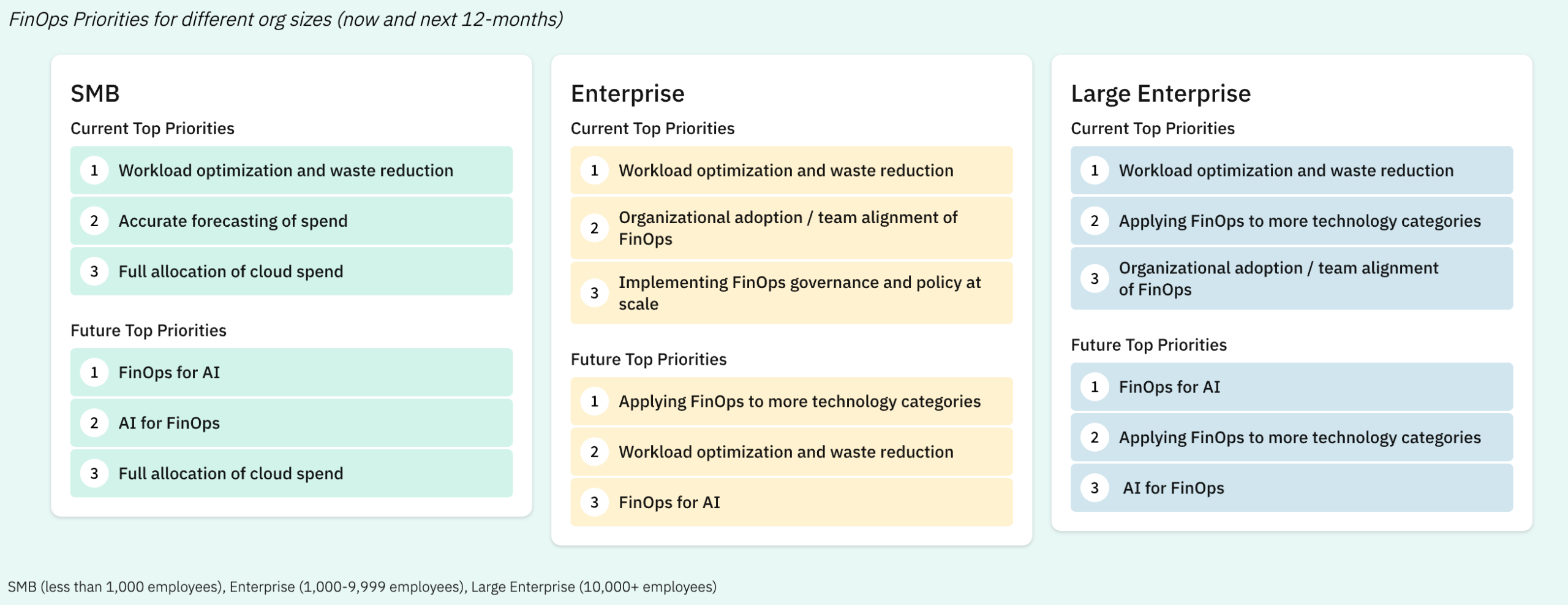

There’s a temptation, reading reports like this one, to conclude that cost optimization is passé. It isn’t. Waste reduction remains the single top current priority across the survey. The nuance is in the forward-looking data, where FinOps for AI, scope expansion, and governance collectively outpace optimization as priorities for the coming year.

What’s actually happening is a maturity split. In organizations that have been doing FinOps for 4–5+ years, the easy savings have been captured. The conversation has naturally moved toward forecasting, unit economics, and influencing decisions before spend happens. In organizations earlier in their journey, optimization is still delivering real value — and should be.

The mistake would be to skip the foundational work because it feels less sophisticated. Visibility and allocation come before optimization in every technology category, every time.

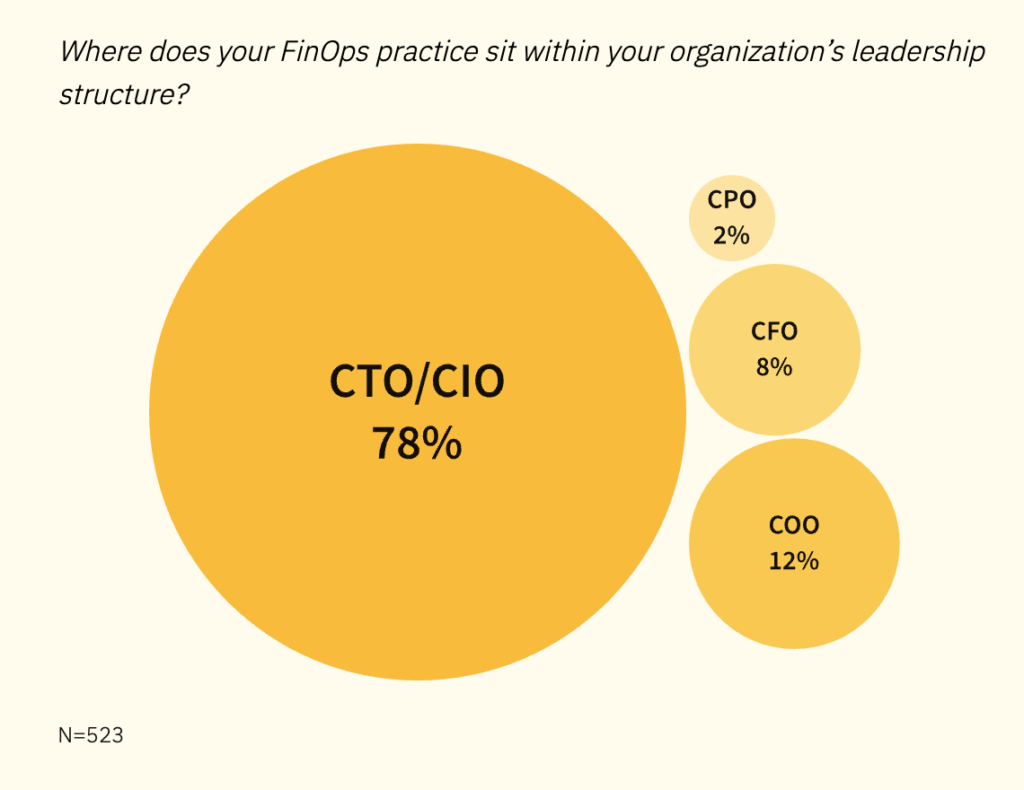

4. Where FinOps Sits in the Org Chart Actually Matters Enormously

78% of FinOps practices now report to the CTO or CIO. Teams reporting to the CFO are down to 8%.

This might sound like organizational trivia, but the data attached to it is striking. Teams with VP/C-suite engagement are 2–4x more likely to influence decisions about cloud provider selection, service architecture, and cloud-versus-data-center placement. The connection is intuitive once you see it: when FinOps lives in the finance function, it’s reporting on what already happened. When it lives in technology leadership, it gets invited to the conversations that shape what’s going to happen.

The practical implication is that FinOps leaders who are still fighting for a seat in technology leadership meetings — rather than finance review meetings — are playing a different game than those who already have it. If you’re in the former camp, this data gives you a compelling argument to make.

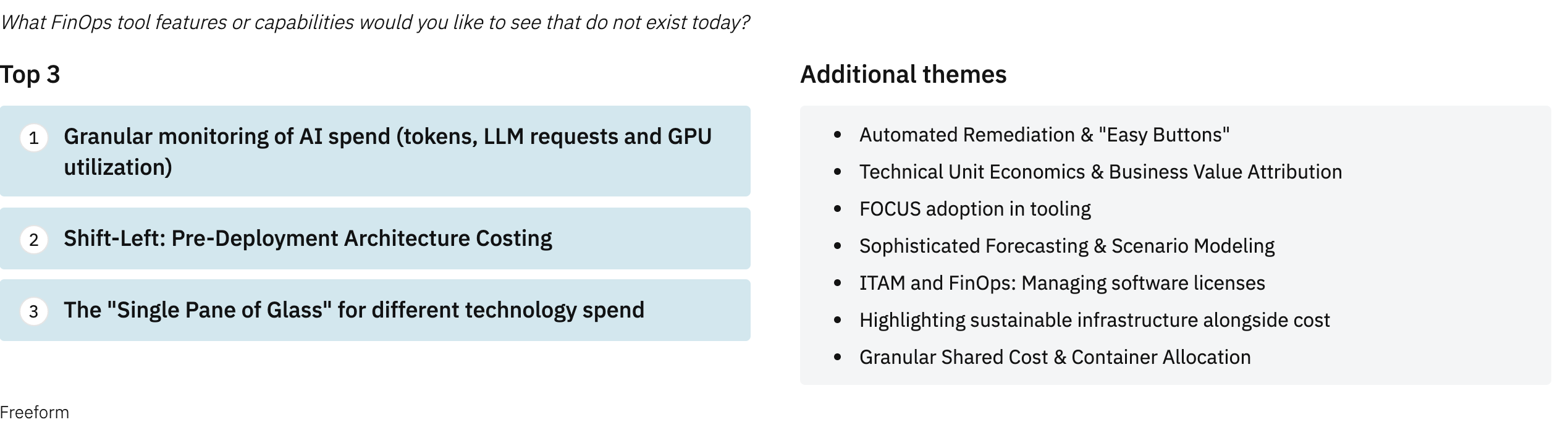

5. “Shift Left” Is the Right Idea With a Measurement Problem That Could Derail It

The principle of shift left — embedding cost awareness earlier in the engineering lifecycle, before resources are deployed — is one of the most intellectually compelling ideas in modern FinOps. It’s also one of the hardest to actually implement.

The tooling gap is real: pre-deployment architecture costing was the top requested feature in this year’s survey, meaning most teams are building their own internal pricing calculators and patchwork solutions rather than relying on commercial tools that actually solve this well. That’s good because that’s what we are aiming for at Holori with our Diagramming feature !

But the deeper problem is behavioral. As one practitioner put it: “Once you fix it, it’s gone. How do we give developers credit for shift-left activities?” If an engineer makes a smarter architecture decision upfront and avoids $200K in annual spend, that savings never shows up anywhere. There’s no anomaly alert, no optimization recommendation, no dashboard number that improved. It just… didn’t cost money. And in most organizations, not spending money doesn’t get you recognized.

Until incentive structures catch up with the shift-left philosophy, adoption will remain partial.

6. Small Teams Are a Feature, Not a Bug — If You Federate Properly

FinOps teams managing $100M+ in annual cloud spend average 8–10 practitioners. That number consistently surprises people outside the FinOps community, but experienced practitioners will tell you it’s about right — if the operating model is designed correctly.

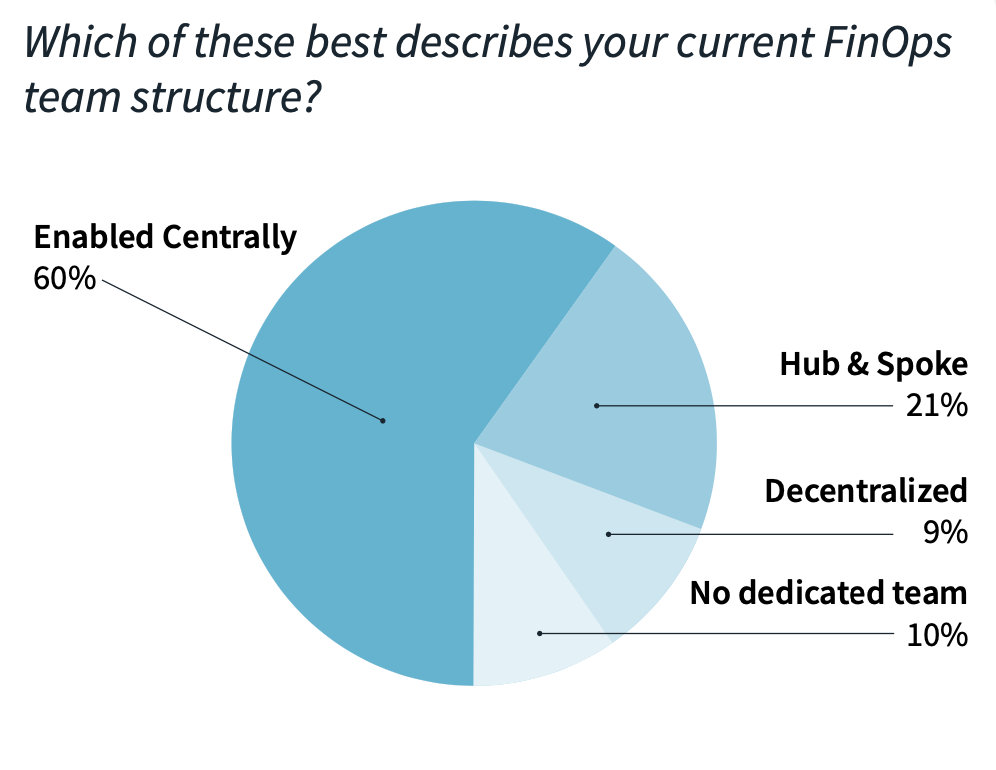

The dominant model, used by 81% of organizations, pairs a small centralized enablement team with federated champions embedded in engineering and business units. The central team sets standards, manages tooling, and handles governance. The embedded champions handle day-to-day execution and carry the FinOps culture into their teams.

What makes this work isn’t the structure itself — it’s what the central team does with the leverage it has. The best central teams spend their time building automation, creating self-service tools, and enabling their federated network. Teams that try to do everything centrally hit a wall quickly.

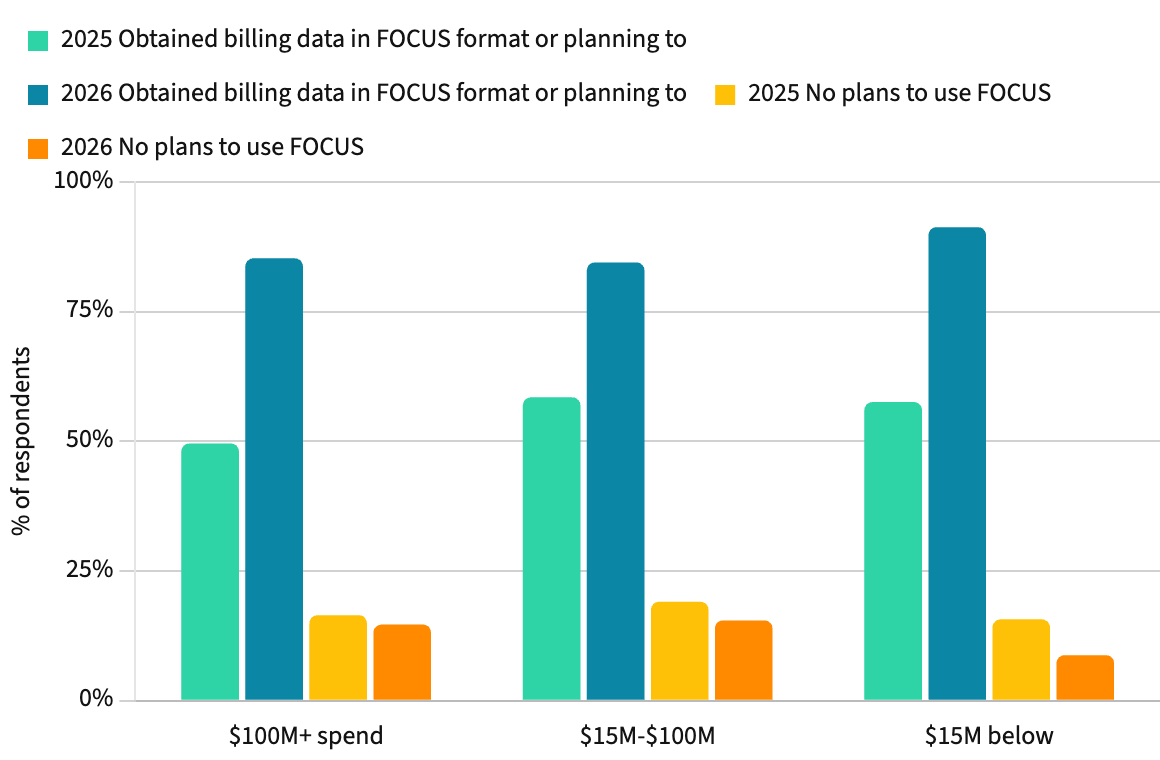

7. FOCUS Is the Infrastructure That Makes Multi-Technology FinOps Possible

The FinOps Open Cost and Usage Specification (FOCUS) doesn’t generate a lot of excitement in casual conversation, but it’s arguably one of the most important developments in the FinOps ecosystem right now.

As teams expand from cloud into SaaS, data centers, and AI, they’re increasingly drowning in billing data that looks completely different across every provider and service. FOCUS is an attempt to create a common language for all of it — a normalized cost and usage schema that works whether you’re looking at an AWS invoice, a Snowflake bill, or a data center chargeback.

Adoption is growing, but the top practitioner request is for more providers and service categories to support it — particularly AI workloads, data center infrastructure, and broader SaaS/PaaS coverage. The specification is only as useful as its coverage, and coverage is still catching up to where FinOps scope already is.

State of FinOps 2026 in a nutshell

Reading the full State of FinOps 2026 report, a few things feel clear. FinOps as a discipline has genuinely matured — it’s earned real influence, expanded its remit significantly, and is starting to shape technology strategy rather than just explain it after the fact.

But the pace of change is also creating real strain. Teams are being asked to manage AI they can’t fully see, govern SaaS and licensing with less tooling support than they had for cloud, measure value instead of just cost, and shift left into engineering processes that weren’t designed with FinOps in mind.

The organizations that navigate this well won’t necessarily be the largest or the most technically sophisticated. They’ll be the ones that resist the temptation to boil the ocean — that pick the two or three areas where expanded FinOps scope delivers real value for their specific context, build the data foundation to do it properly, and connect it to the decisions that actually matter to their leadership.

That’s always been the real skill in FinOps. The tools and the scope have changed. The fundamentals haven’t.