The cloud market continues to demonstrate exceptional growth — and the rise of AI has only amplified this momentum. In 2025, the impact became even more visible: global cloud infrastructure (IaaS) spending reached US $90.9 billion in Q1 2025 alone — a 21% year-over-year increase. Overall, the global cloud computing market (including IaaS, PaaS, and SaaS) is now valued at approximately US $943 billion in 2025, and is on track to surpass US $1 trillion in early 2026.

Fueled by generative AI, hybrid and multi-cloud adoption, and global data acceleration, the cloud industry has entered a new phase of hypergrowth. AI workloads and GPU-intensive training environments are driving record demand for compute and storage capacity across hyperscalers and alternative providers alike.

Understanding cloud market share among service providers (CSPs) is more than a ranking exercise — it helps businesses assess vendor strength, ecosystem maturity, pricing power, regional reach, and long-term viability.

In this article, we’ll explore:

1-The current cloud market size and growth trajectory,

2- The 2025 cloud market share landscape heading into 2026,

3- Emerging trends reshaping competition over the next 12–18 months, and

4- What this means for business strategy, including FinOps adoption and multi-cloud management.

Global Cloud Infrastructure Market: Size & Growth

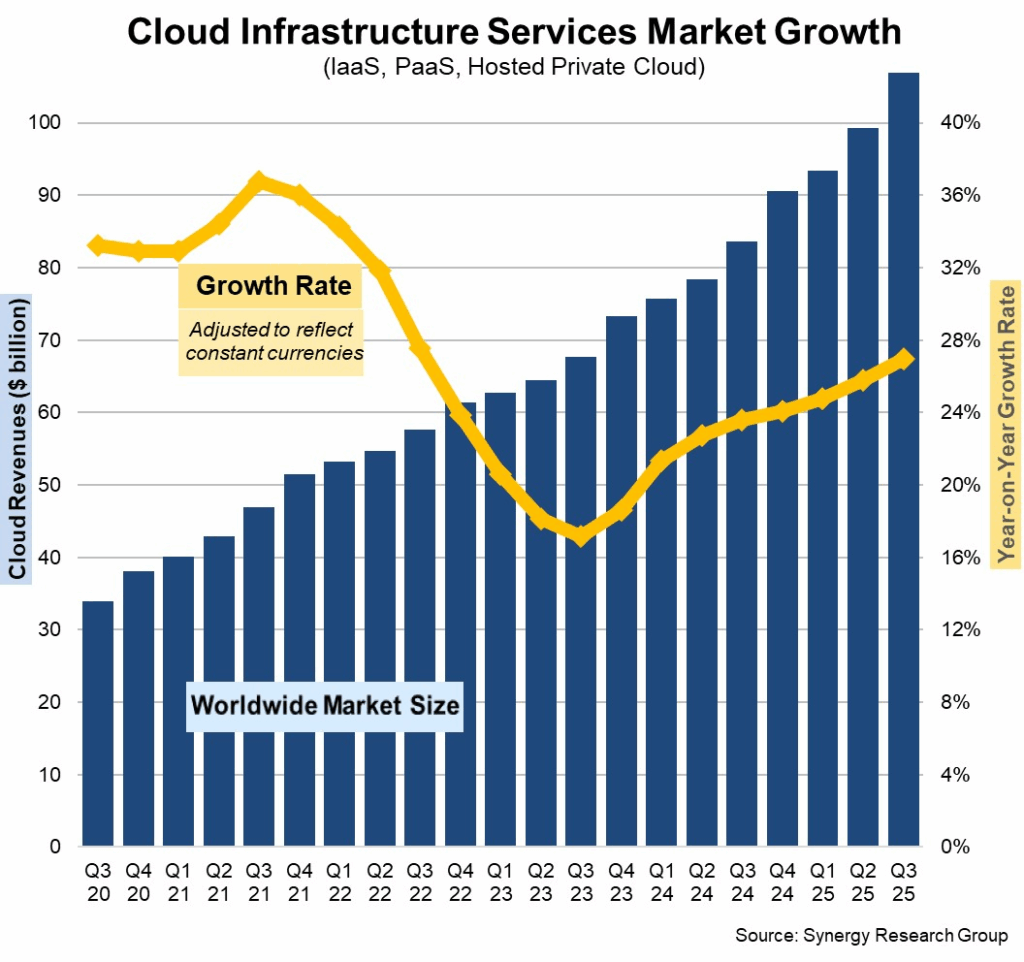

The infrastructure services segment (IaaS + PaaS + key managed cloud infrastructure) continues to be the fastest-growing pillar of the cloud industry. According to Synergy Research Group, enterprise cloud infrastructure revenues surged to US $106.9 billion in Q3 2025, marking a record-breaking $7.5 billion sequential increase and a 28% year-over-year growth—the strongest performance seen in the past three years. Over the trailing twelve months, the market generated nearly US $390 billion in revenue, a testament to how deeply cloud services have become embedded in modern enterprise IT.

GenAI remains the key catalyst behind this acceleration. Massive GPU-powered workloads, LLM training, and inference hosting have driven extraordinary cloud consumption across industries. Public IaaS and PaaS services continue to dominate, expanding nearly 30% in Q3 alone, while GPU-as-a-Service (GPUaaS) revenues are now growing at more than 200% per year.

Geographically, the market remains robust across all regions. The U.S. continues to dominate, expanding 27% year-over-year in Q3, while Western Europe grew by 24% in 2025 compared with 2024, according to Brightlio. Other high-growth regions included India, Ireland, Mexico, and South Africa, each outpacing global averages.

As the market base expands, even a 20% annual growth rate now represents tens of billions in new spending, fueling opportunities for challengers and reshaping market dynamics. The cloud industry’s growth story is far from over — but the pace and direction are now decisively being shaped by AI, hybrid adoption, and the economics of scale.

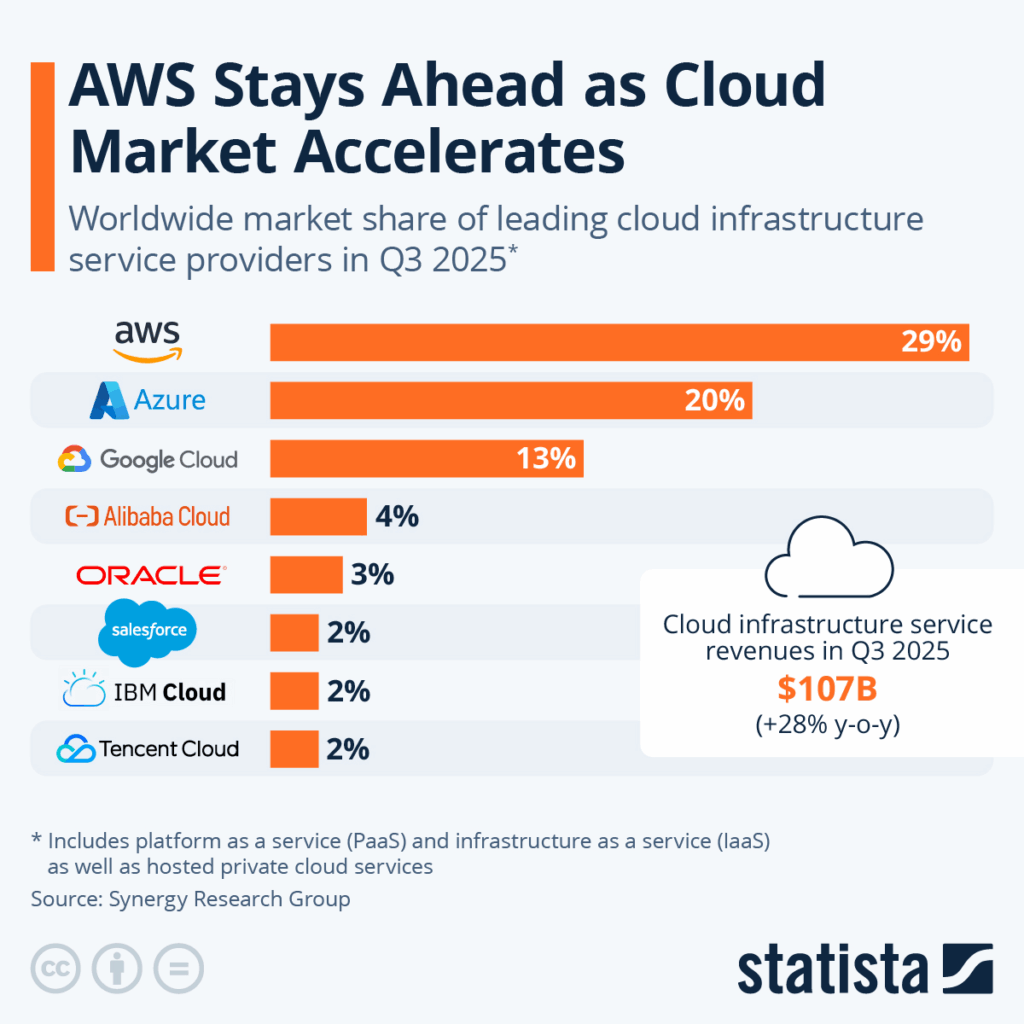

Top Cloud Providers: 2025 Market Share Snapshot

Here’s where the major players stood in 2025 as we head into 2026 — data mostly from Q2 2025 and Q3 2025.

Among the hyperscalers, Amazon Web Services (AWS) maintains a strong lead with a 30% global market share, followed by Microsoft Azure at 20% and Google Cloud at 13%. Despite AWS’s leadership, Azure and GCP continue to post higher quarterly growth rates, driven by AI and enterprise hybrid cloud adoption. Microsoft’s deep integration of Azure with OpenAI and Google’s expansion of its Gemini and Vertex AI ecosystems continue to attract heavy enterprise and developer workloads.

Beyond the “Big Three,” Tier 2 and emerging players are reshaping the competitive landscape. CoreWeave, Oracle, OpenAI, Databricks, and Huawei Cloud posted the fastest growth rates in Q3 2025. CoreWeave, in particular, has exploded from a niche AI GPU provider into a near top-10 global cloud vendor, generating over $1 billion in quarterly cloud revenue from its AI infrastructure services..

| Provider | Approx. Global Market Share (2025) | Key Notes |

|---|---|---|

| Amazon Web Services (AWS) | ~30% in Q2 2025. | Still the leader, though share has dipped slightly from ~32-33%. |

| Microsoft Azure | ~20% in Q2 2025. | Second place, but growth remains strong. |

| Google Cloud (GCP) | ~13% in Q2 2025. | Gaining ground, especially via AI/data workloads. |

| Alibaba Cloud | ~4% globally. | Dominant in China, but global footprint remains limited. |

| Oracle Cloud Infrastructure | ~3% globally. | Strong niche in enterprise ERP + database tie-ins. |

| Others & Regional Players (IBM, Tencent, etc.) | Each ~1-3%. | Collectively “rest of market” is still large and growing. |

The Comparison: AWS vs. Azure vs. GCP

AWS: With its early-mover advantage, extensive service catalogue (>200 services), and strong global infrastructure, AWS is still the default for many workloads. But its growth rate has slowed – Q2 2025 growth was ~17% year-on-year.

Azure: Microsoft leverages its enterprise ecosystem (Office 365, Windows, LinkedIn) and hybrid tools (Azure Arc, Stack) to win large enterprise deals. Its global share (~20%) hides pockets of higher penetration in enterprise sectors and regions.

GCP: Google’s strength in data analytics, machine learning, and AI is paying off — its share climbed to ~13% in Q2 2025. It still trails in enterprise footing, but growing fast.

The three-way dynamic means that while AWS is dominant, any slip in growth opens the door for Azure or GCP to narrow the gap — particularly in AI infrastructure, hybrid cloud, or industry verticals.

Regional & Niche Providers Matter

While the global headlines focus on the hyperscalers, regional and vertical specialists remain critical pieces of the cloud market landscape.

- China: In China the cloud ecosystem is dominated by local players. For example, Tencent Cloud held ~15% of China’s market in Q3 2024.

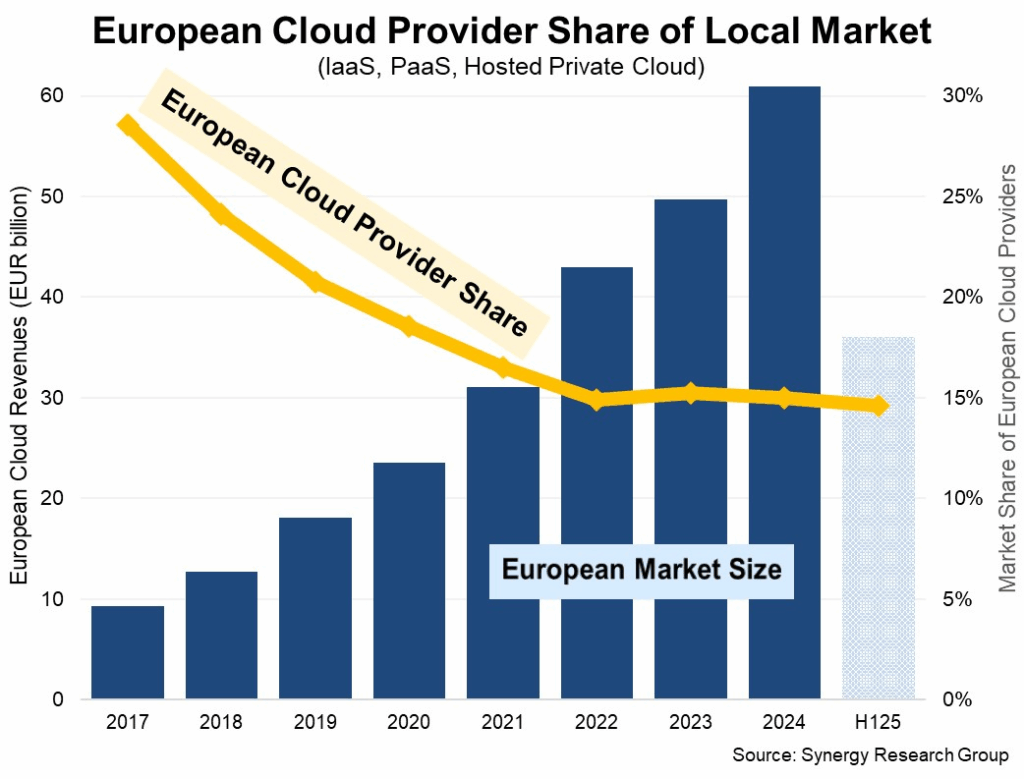

- Europe: European providers captured around 15% of the EU market in 2022 and continue to be a growing force.

- Alternative providers: Companies like Oracle OCI, IBM Cloud, regional MSPs and specialized AI-cloud providers (e.g., GPU/ML infrastructure) are gaining traction.

These players matter for localized data-sovereignty, regulatory fit, niche workloads, edge/AI deployments, and multi-cloud strategies.

Europe’s Shift Toward Regional Clouds and the “Tariff Effect”

While the global cloud market remains dominated by U.S. hyperscalers like Amazon Web Services (AWS), Microsoft Azure and Google Cloud (GCP), a strategic realignment is underway in Europe. European cloud providers still account for only around 15% of the European infrastructure cloud market, but they are gaining momentum amid changing geopolitics.

One catalyst: rising U.S. tariffs and trade tensions under Donald Trump’s trade policy framework, which raised concerns about supply-chain exposure, reliance on U.S.-based infrastructure, and total cost of ownership for European enterprises. In this context, OVHcloud has raced ahead — crossing the €1 billion annual revenue mark in FY 2025 (≈€1,084.6 million, up ~9.3% year-on-year) and achieving an adjusted EBITDA margin of 40.4%. This milestone matters: OVHcloud now reports more than €100 million in U.S. revenue and over €100 million from its Public Cloud segment, and serves nearly 1,200 corporate clients each with more than €100 000 in ARR.

European enterprises — particularly regulated industries and public sector bodies — are increasingly opting for region-based cloud providers to address sovereignty, compliance, and cost concerns. The tariff and geopolitical pressure acts as a wake-up call: cloud choice is no longer purely about performance or features, but also about strategic independence and total cost predictability.

Emerging Trends Shaping Cloud Market 2026

Generative AI & Infrastructure Surge

The rise of generative AI is a major inflection point. Compute, storage, GPU/TPU-based infrastructure demand is exploding — driving hyperscaler growth and creating openings for specialized cloud players (e.g., AI-optimized infrastructure hosts). Synergy found GenAI-specific cloud services grew 140-180% in Q2 2025 year-on-year.

AWS, Azure, and GCP are investing heavily in AI infrastructure, training services, and data platforms — meaning share shifts will be influenced by who wins the AI workload wars.

Multi-Cloud & Hybrid Adoption

Enterprises increasingly adopt multi-cloud or hybrid architectures to spread risk, leverage best-of-breed services, meet compliance/locality demands, and avoid vendor lock-in. This dynamic gives regional and niche providers a chance to increase share — especially for workloads less suited to the mega-cloud model.

Pricing Pressure & Cost Optimization

With economic headwinds, inflation, and increasing scrutiny of cloud spend, enterprises are pushing providers harder on cost optimization, discounting, reserved commitments, and FinOps practices. Leaders who can deliver better value (performance per dollar) will be best positioned for share gains.

Regulation & Data Sovereignty

Regulations (especially in Europe, Asia, and Latin America) around data sovereignty, antitrust, cloud interoperability and digital sovereignty will influence share — especially where regional providers have regulatory advantage or local infrastructure.

Infrastructure Edge & Vertical Clouds

Edge computing, industry-specific cloud offerings (vertical clouds for healthcare, manufacturing, finance) and specialized infrastructure (e.g., IoT, 5G, high-performance compute) will open pockets of growth outside the mainstream hyperscaler focus.

What This Means for Businesses in 2026

- Selecting Cloud Providers: Market share gives a rough proxy for vendor strength, ecosystem maturity, pricing power, risk of vendor exit. But it’s not the only metric. Decide based on your workload, budget, region, and strategic drivers — hybrid/multi-cloud strategy remains smart.

- FinOps is mandatory: As cloud spend increases, running cloud without cost optimization is a risk. Use tools and platforms to track spend by team, product, customer, allocate costs, rightsise and predict growth.

- Avoid vendor lock-in risk: Even dominant providers must be treated as part of a broader strategy. Leverage multi-cloud, keep abstraction layers, and retain negotiation leverage.

- Evaluate AI workload readiness: If your business relies on AI/ML or high-performance compute, provider selection matters. Look at GPU/TPU availability, performance per dollar, and ecosystem for AI workflows.

- Regional & Niche providers are strategic: For compliance, localization, edge deployments, or specialized vertical use-cases, don’t ignore smaller providers just because their global share is smaller.

Outlook: Who Gains Share in 2026?

- AWS: Likely to maintain its lead but will face pressure from growth-oriented challengers (Azure, GCP) and niche players.

- Azure: Poised to gain further enterprise and hybrid share thanks to its ecosystem and AI investments — expect incremental share gains in 2026.

- GCP: With AI/data differentiation, could cross ~15% global share in 2026 if momentum holds.

- Alternative providers: Expect modest but meaningful share shifts, especially regionally and in edge/AI segments.

- The overall market: Will continue to grow strongly — likely mid-20% CAGR in 2025-26 for infrastructure spend.

Why FinOps Has Become Essential in the 2026 Cloud Landscape

As the cloud market expands beyond $400 billion annually, organizations are facing an unprecedented rise in complexity — not just in architecture, but in cost management. Every AI workload, GPU cluster, and multi-region deployment adds layers of variable spend that are often invisible until the invoice arrives.

This is where FinOps (Cloud Financial Operations) becomes mission-critical. FinOps aligns engineering, finance, and leadership teams to bring accountability and visibility into cloud spending. It helps businesses answer questions like:

- How can we allocate costs across departments?

- Why did cost increased ?

- How to make team responsible for their own costs?

- Can we forecast next quarter’s cloud bill with confidence?

With the growing use of multi-cloud and AI-driven workloads, cost transparency is no longer optional — it’s strategic. The companies leading cloud maturity in 2026 are those treating cost management as an operational discipline, not just a finance exercise.

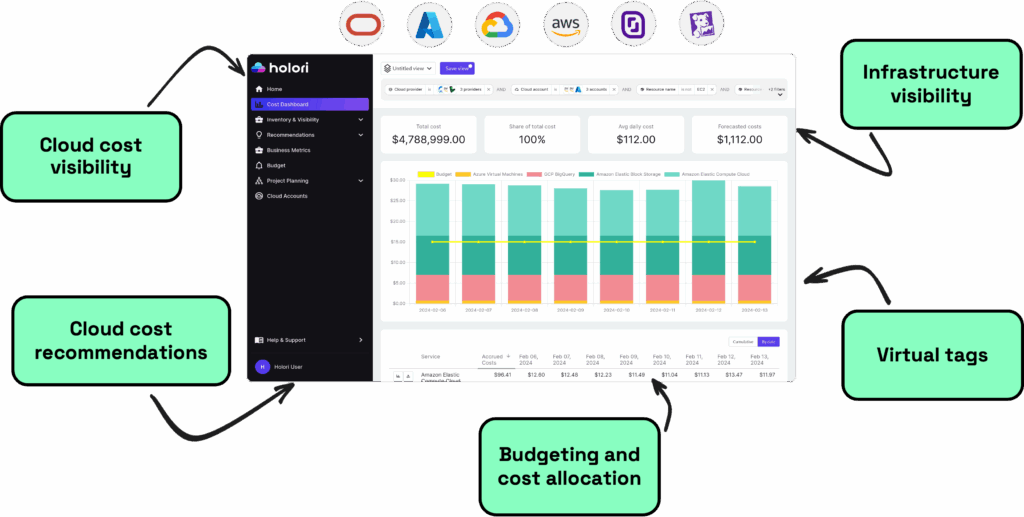

That’s where platforms like Holori come in.

Holori provides a unified dashboard that visualizes infrastructure across cloud providers, correlates it with spending, and enables teams to act directly on insights. Whether it’s rightsizing instances, tracking egress fees, or breaking down costs by project, Holori turns FinOps data into actionable architecture decisions.

Conclusion

Understanding cloud market share heading into 2026 isn’t just about tracking “who’s winning.” It’s about understanding vendor maturity, ecosystem reach, service breadth, and strategic positioning — all of which matter when you’re committing tens or hundreds of millions in cloud spend.

The dominant trio — AWS, Azure, GCP — continue to hold the lion’s share. But the rise of AI, hybrid & multi-cloud strategies, and regional/vertical specialization are shifting the dynamics.

For businesses, the takeaway is clear: choose providers not only for share but for strategic fit, cost efficiency, and future-proof capabilities. As your cloud footprint grows, ensure you have the visibility, cost controls and architecture discipline to make your investments pay off — before the next wave of disruption hits.

FAQ – Cloud Market Share 2026

1. Who is the largest cloud provider in 2026?

As of 2026, Amazon Web Services (AWS) remains the global leader in cloud infrastructure, holding around 31% of the market share, followed by Microsoft Azure (25%) and Google Cloud Platform (11%). Together, these three hyperscalers control over two-thirds of the global cloud market.

2. Why is the cloud market growing so fast?

The rapid growth is fueled by AI workloads, data analytics, and the ongoing digital transformation of enterprises. Generative AI in particular has driven massive demand for compute and GPU-based resources, accelerating overall cloud spending.

3. What is driving Azure’s strong performance?

Microsoft Azure benefits from its deep integration with enterprise products such as Office 365, Dynamics, GitHub, and LinkedIn. This ecosystem makes Azure the default choice for many large organizations, especially those pursuing hybrid cloud strategies.

4. Are European cloud providers gaining ground?

Yes. OVHcloud, Scaleway, Hetzner, and Deutsche Telekom’s Open Telekom Cloud have seen increased adoption, driven by data sovereignty laws and new trade tariffs on U.S. tech products. OVHcloud, for instance, surpassed €1 billion in annual revenue in FY 2025 — a major milestone for a European CSP.

5. What role does FinOps play in the modern cloud landscape?

As cloud costs surge with AI and multi-cloud adoption, FinOps practices help companies monitor, allocate, and optimize their spending. Tools like Holori make these practices actionable by connecting cost visibility directly to infrastructure, enabling real-time financial governance.

6. What’s next for the global cloud market?

The cloud industry is on track to exceed $1 trillion in total market value by 2026, with continued expansion driven by AI, edge computing, and sustainability-focused GreenOps initiatives. Meanwhile, regional diversification and sovereign cloud adoption will reshape the competitive landscape.