The Covid-19 pandemic has accelerated the adoption of cloud computing. Cloud has played a key role in maintaining activities during the outbreak. With employees working from home, using conferencing system and remote connection/access to their working tools, cloud technology has been essential for the economy to cope with the crisis. Scalability and elasticity of the cloud has proven the limitations of legacy applications and infrastructure during challenging times.

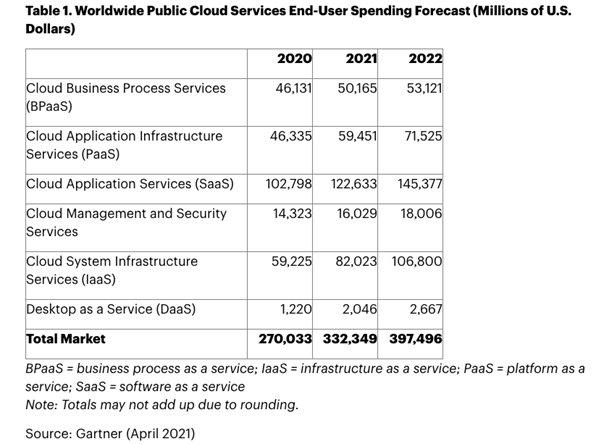

According to Gartner, global public cloud spending is forecast to reach $332.3 billion in 2021, increasing by 23.1% from $270 billion in 2020.

Let’s see the cloud market size and growth in the major regions :

American cloud market

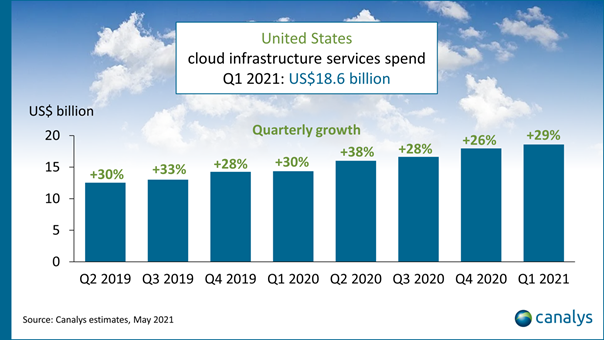

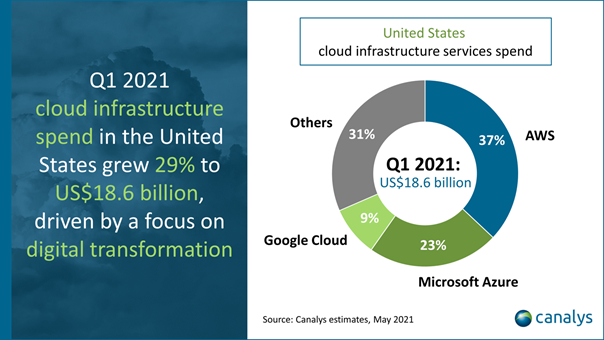

Without surprises the US cloud market is the largest one by far and represents 44% of total spend. On the above chart we can see important growth spikes (38%) during covid crisis and more recently a growth of 29% in Q1 2021 to reach a record of $18,6B.

The main cloud providers were AWS with 37%, Azure with 23% and GCP with 9%. AWS, Azure and Google cloud have plan to open new datacenters in the US in 2021 to keep their leadership. For example Microsoft Azure plan to open Georgia and Arizona in 2021 and possibly more as they recently announced to build 50 to 100 new datacenters each year worldwide.

European cloud market

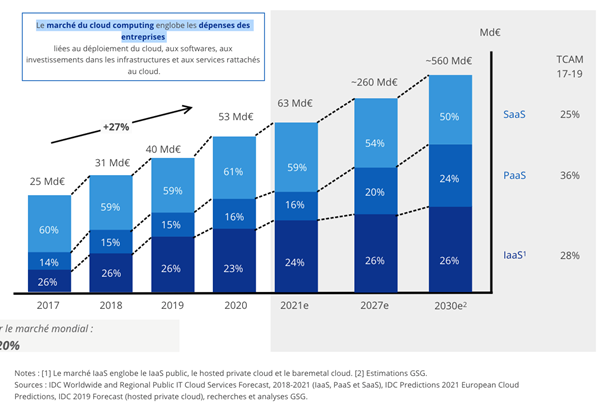

The European cloud market has also grown more during Covid time but it is only the third market after US and China.

The European market has national cloud providers such as Deutsche Telekom, OVH, Scaleway, Orange and different national telcos. Those providers are fighting against the world leading cloud providers : AWS, Azure, GCP who accounts for 66% of the market whereas 3 years ago, they accounted for only half of the market.

“European cloud providers are trying to gain more traction in the market by focusing on customer segments and use cases that have stricter data sovereignty and privacy requirements. This has led to the Gaia-X initiative which represents an attempt to reverse the fortunes of the European cloud industry,” said John Dinsdale, a chief analyst at Synergy Research Group.

Despite its delay compared to the other major regions, the European cloud market is expected to grow very strongly in the coming years with new datacenters popping up across the continent.

Different scenarios forecast the European market to reach more than 300B$ by 2030 which equals to the current market size worldwide.

Chinese cloud market

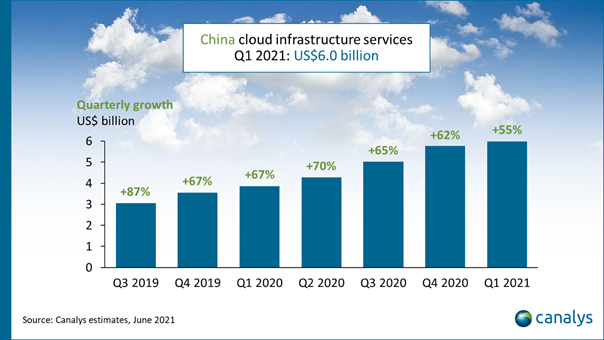

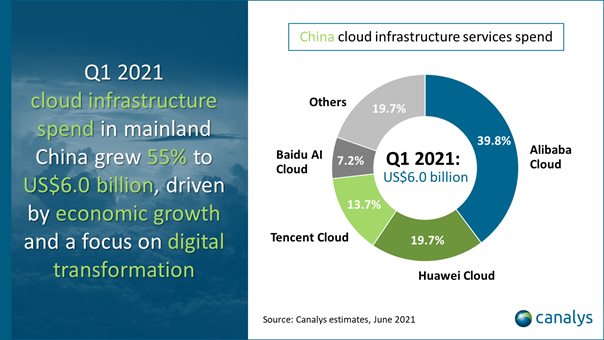

The Chinese cloud market continues to outpace the rest of the world with average growth that is twice more important than in the US (60 vs 30%). In Q1 2021 China’s cloud infrastructure spend reached 6B$ which accounts for 14% of the worldwide cloud market.

As on the other market regions, the pandemic has accelerated the growth, in Q2 2020 we can see a peak of 70% of growth. There are other underlying reasons for this fast growth:

- China is the only major economy who reported economic growth for 2020 with a GDP that grew by 2,6%.

- The Chinese government has made cloud computing a top priority through its “internet plus” Strategy in 2015. The government is promoting and subsiding the cloud industry.

- Chinese tech giant such as Alibaba, Tencent, Baidu, Huawei offer cloud solutions and can compete against their American rivals as they have an equivalent size.

The main cloud providers in the Chinese cloud market are Alibaba, Huawei Cloud, Tencent and Baidu AI Cloud, which together accounts for more than 80% of total expenditure. Laws that prioritize Chinese companies makes it hard for their American competitors to enter the market.

Chinese cloud providers are now targeting to expand in Europe, Asia and emerging countries. As with the 5G network, we can expect a digital war between US and China.

Key cloud providers worldwide

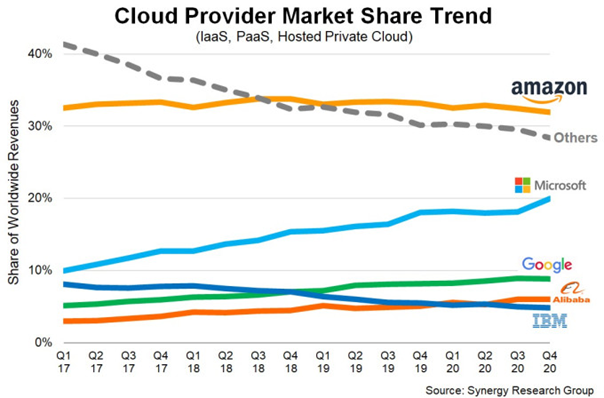

The market is dominated by 3 majors cloud providers sharing almost 60% of the pie. AWS is the leader with 33% of market share, Azure closely follows with 19% and Google Cloud with 7% of market share. Shortly after comes Alibaba with a little less market share than Google.

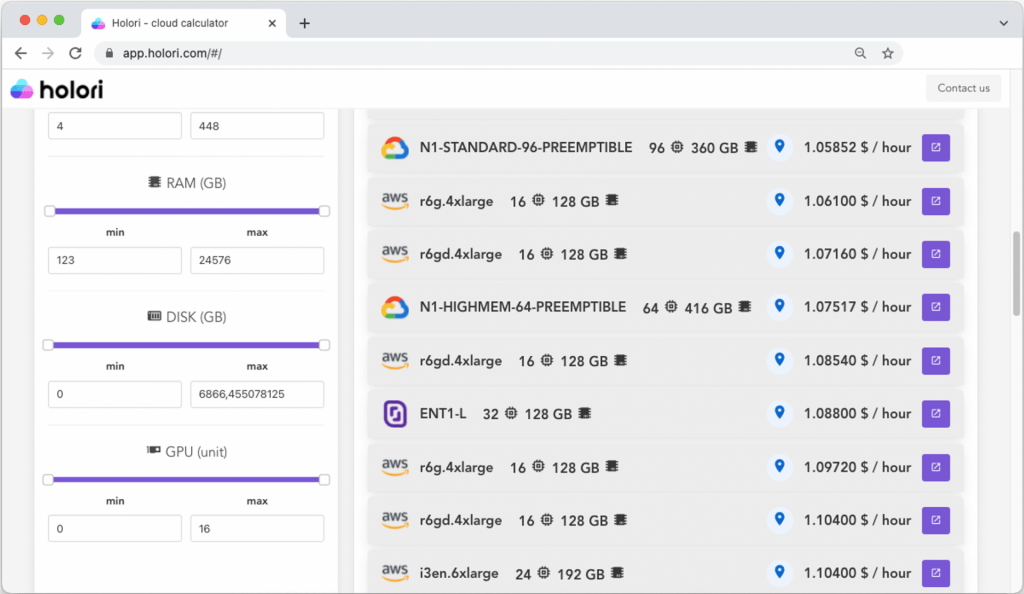

Let’s compare AWS vs Azure vs Google cloud vs Alibaba. By the way Holori has developed the most comprehensive cloud pricing calculator on the market to compare cloud providers services. You can try it out for free here https://app.holori.com/compare

Amazon Web services

Amazon is an interesting case as its market share have plateaued around 33% with an increasingly growing market. It actually means that AWS cloud revenues have kept increasing over the past years.

AWS has started the commercialization of their cloud products 10 years ago and remains market leaders despite the increasing competition.

AWS is leading the technology and commercial battle. When Amazon is implementing a technology or a new business model, other follows.

Bezos has said, “AWS had the unusual advantage of a seven-year head start before facing like-minded competition. As a result, the AWS services are by far the most evolved and most functionality-rich.”

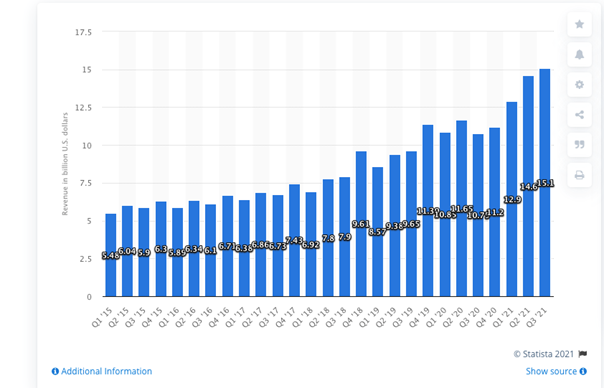

AWS reported 13,5B$ in revenue during Q4 2021which represents 12% of Amazon total revenue and 4B$ in operating income which accounts for 47% of Amazon operating total operating income.

AWS continues to drive Amazon company as a whole toward profitability.

Recently Jeff Bezos announced that he was stepping down as CEO of Amazon and former CEO of AWS, Andy Jassy, will take over the position. Without doubt Andy Jassy outstanding track record has played a role in being appointed CEO.

Microsoft Azure

Microsoft is certainly AWS biggest rival.

Last year Microsoft Intelligent cloud division revenue reached 44B$ which is very close to AWS but here is the trick : this division encomprises many other services such as Microsoft SQL Server, Windows Server, Visual Studio, System Center, and related CALs, Microsoft Azure, and GitHub.

In Q3 2021, revenue of Intelligent Cloud division grew by 23% to reach $15.1 billion. The segment was Microsoft’s largest division by revenue and by operating income $6,4 billion. It was driven by a 50% increase in revenue for Microsoft’s Azure cloud computing platform.

Microsoft CEO Satya Nadella said: “Over a year into the pandemic, digital adoption curves aren’t slowing down. They’re accelerating, and it’s just the beginning. We are building the cloud for the next decade, expanding our addressable market and innovating across every layer of the tech stack to help our customers be resilient and transform.”

Back in 2017 Azure revenue where at the same level than Google cloud. Microsoft Azure saw its revenue soar faster than its main competitor and became the second player on the market.

Microsoft Azure had impressive growing stats with growth reaching 90% in Q1 2018, 98% in Q2 2018, 93% in Q3 2018, 89% in Q4 2018, 76% in Q1 2019, 76% in Q2 2019, 73% in Q3 2019 and 64% in Q4 2019.

Google cloud

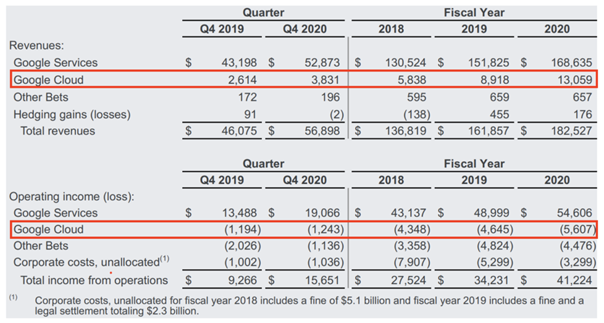

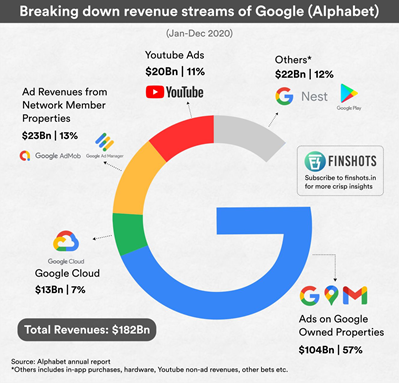

Google Cloud is the third largest cloud provider with 13 billion revenue in 2020.

Similar to Microsoft Azure, Google cloud division includes reviews from other sources such as Google workspace. Google cloud revenue climbed nearly 54 percent in Q2 2021, which is higher than AWS and Microsoft Azure. GCP revenue reached 4.6 billion in Q2 2021 instead of $3B at the same period last year. Google cloud is on track to reach $18 billion revenue in 2021.

Google Cloud’s operating loss dropped to $591 million in Q2 2021, compared to $1.43 billion in Q2 2020.

“Looking forward, we will continue to focus on revenue growth driven by ongoing investment in products and the go-to-market organization. Cloud’s operating loss reflects that we have meaningfully built out our organization ahead of revenues, as we’ve discussed in prior quarters with respect to the substantial investments in our go-to-market organization as well as engineering and technical infrastructure. Operating loss and operating margin will benefit from increased scale over time.”

When comparing full-year results for 2018 and 2020, we can notice a revenue increased of 124% from $5.84 billion to $13.01 billion. Moreover, within the same period of time, Google Cloud’s losses increased by only 29%, from $4.35 billion to $5.61 billion.

To summarize, revenue is up 124% but losses is only up 29%.

It’s always interesting to see Companies’ revenue breakdown and identify which division generate the most profit. In 2020 Google Cloud revenue represented 7% of google total turnover. At the moment Google Cloud division is the smallest in terms of revenue and doesn’t have the same impact on group profitability such as AWS or Microsoft Azure so there is plenty of room for improvement.

Alibaba cloud

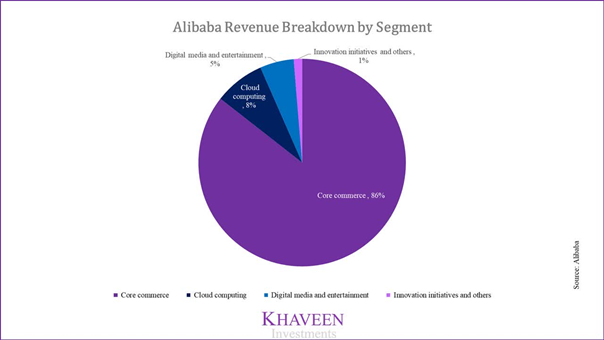

Alibaba cloud is the 4th largest cloud provider worldwide just after google Cloud with $5,7B revenue in 2020. After 11 years of service the Cloud division of Alibaba only became profitable in Q4 2020. According to Canalys, Alibaba cloud has almost 40% market share on its domestic market in China but only 5% market share worldwide. The firm currently has data centers in 67 availability zones across 22 regions worldwide.

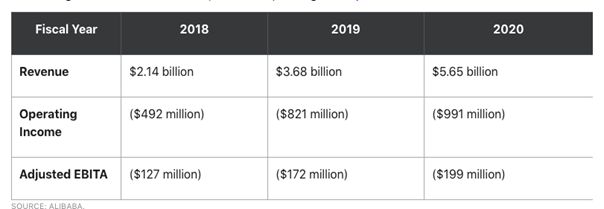

As you can see in the table below, Alibaba cloud increased its revenue from 2,14 Billion in 2018 to $5,65B in 2020.

E-commerce remain Alibaba’s largest revenue driver in the quarter, accounting for nearly 70% of revenue, while cloud contributed 7%.

Alibaba’s e-commerce margins will probably keep decreasing, Therefore Alibaba will need to turn its cloud division into a profitable business soon. Alibaba seems to be on the right track, but competition from Tencent and Huawei could still generate new challenges.

Cloud market perspective

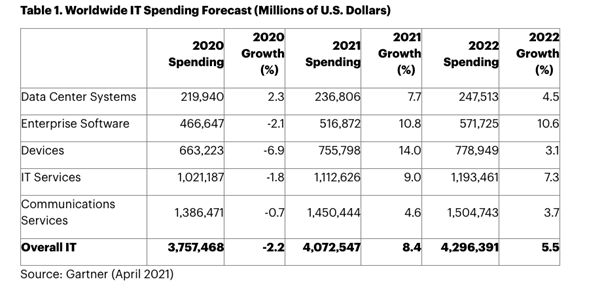

According to Gartner, worldwide overall IT spending in 2020 was $3.8 trillion. It actually means that the cloud infrastructure market accounted for only 7% of total IT spendings in 2020. This leaves a tremendous room for growth and for the cloud market to reach trillions in the future.